The Market Structure Bill, a pivotal piece of legislation aimed at clarifying U.S. oversight of digital assets, has been postponed until 2026. This delay, announced by the Senate Banking Committee in late 2025, stems from unresolved bipartisan negotiations. For crypto investors, it signals prolonged uncertainty in an already volatile market. As the industry awaits clearer rules on everything from token classifications to agency jurisdictions, this holdup could influence short-term price swings and long-term growth strategies.

Crucial Crypto Market Structure Bill Sparks High-Stakes Meeting …

Understanding the Market Structure Bill: A Primer

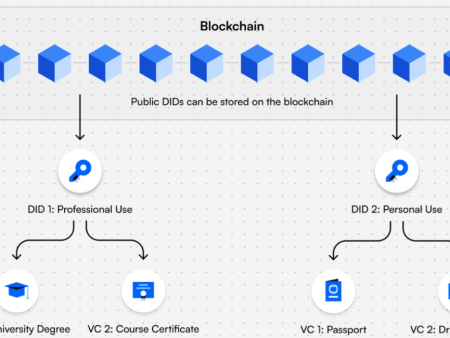

At its core, the Market Structure Bill seeks to define how federal regulators oversee cryptocurrencies. Think of it as drawing lines on a map. The Securities and Exchange Commission (SEC) traditionally handles securities, while the Commodity Futures Trading Commission (CFTC) manages commodities like futures. Crypto blurs these boundaries—some tokens act like stocks, others like gold.

The bill, often referred to as the CLARITY Act in Senate discussions, would assign the CFTC primary authority over spot markets for non-security digital assets, such as Bitcoin and Ethereum. This shift aims to reduce the SEC’s enforcement-heavy approach, which has led to lawsuits against major players like Coinbase and Binance. For beginners, imagine the bill as a referee’s rulebook: without it, games get chaotic, with penalties handed out unpredictably.

Drafts from both the Senate Banking and Agriculture Committees emphasize “permissionless transfer” for commodities and ties to blockchain functionality. However, these definitions remain fluid, affecting how tokens are traded, custodied, and taxed.

The Road to Delay: Current Developments and Senate Dynamics

The Senate’s decision to push markup hearings—where committees debate and amend bills—into 2026 came amid a flurry of end-of-year priorities. Chairman Tim Scott confirmed ongoing talks but cited time constraints, including a looming January 30, 2026, government funding deadline that could trigger a shutdown. Bipartisan progress exists, yet the holiday recess halted momentum.

Moreover, the 2026 midterm elections add pressure. With Democrats holding an 80% chance of retaking the House, per recent polls, lawmakers may hesitate on controversial votes. This political calendar compresses the window for action, as campaigns often sideline complex legislation.

Real-world relevance shines through in crypto’s 2025 performance. Despite the delay, spot Bitcoin and Ethereum ETFs amassed $31 billion in net inflows, underscoring growing interest even without full clarity. However, the absence of the Market Structure Bill leaves gaps, forcing reliance on interim regulatory interpretations.

Key Sticking Points in the Market Structure Bill

Several disagreements have stalled progress. First, DeFi regulations pose a major hurdle. Democrats advocate for stringent anti-money laundering (AML) rules on decentralized protocols, viewing them as potential havens for illicit activity. The industry counters that this could stifle innovation, as DeFi’s permissionless nature defies traditional oversight.

Ethics concerns also loom large. Proposals include bans on officials profiting from crypto ventures, fueled by President Trump’s family links to projects like World Liberty Financial. The White House opposes such measures, creating partisan friction.

Financial stability safeguards round out the list. Yield-bearing stablecoins—those offering returns like interest—remain contentious. Lawmakers worry about systemic risks, similar to how traditional banks manage deposits. Without consensus, these issues push the Market Structure Bill further into 2026.

Regulating Crypto: To Frame, Tame, Or Game The Ecosystem | S&P Global

Pros, Risks, and Common Misconceptions About the Delay

On the positive side, the Market Structure Bill could boost institutional adoption by providing clear rules. Pros include reduced litigation risks for exchanges and faster innovation in fintech. For instance, tokenized assets in real estate or art could thrive under defined commodity statuses.

Yet, the delay introduces risks. Market volatility may spike as uncertainty lingers. Bitcoin dipped from $90,000 to $86,000 shortly after the announcement, highlighting sensitivity to legislative news. Institutional investors, wary of gray areas, might slow inflows, delaying broader mainstream integration.

A common misconception is that no bill means no regulation. In reality, agencies like the SEC will continue enforcement actions, potentially through court rulings rather than statutes. Another myth: the delay kills crypto growth. History shows markets adapt—Ethereum’s merge in 2022 succeeded amid regulatory fog.

What This Means for Market Volatility and Institutional Adoption

The postponement amplifies short-term volatility. Without the Market Structure Bill, price swings tied to news cycles persist. For example, Bitcoin’s 2025 journey saw peaks at $115,761 in July before retreating to $87,766 by December, reflecting policy-sensitive fluctuations.

Here’s a chart illustrating Bitcoin’s monthly closing prices in 2025, showcasing the inherent volatility:

Grok can make mistakes. Always check original sources.

This data-backed insight reveals a 40% swing from high to low, exacerbated by regulatory limbo.

For institutional adoption, the delay is a double-edged sword. While 2025 saw $31 billion in ETF inflows, further growth hinges on clarity. Institutions favor stable environments; without the bill, some may hedge with dynamic strategies or pivot to regulated offshore markets.

The Evolution of the Institutional Crypto Market: From Liquidity …

Actionable Insights for Crypto Investors

Stay informed: Monitor Senate schedules for early 2026 markups. Resources like CoinDesk and Politico offer real-time updates.

Diversify thoughtfully. Balance holdings across Bitcoin, Ethereum, and altcoins less tied to U.S. regs, like those in DeFi. Use tools like hardware wallets for security.

Watch global trends. Europe’s MiCA framework provides a model; if U.S. delays persist, capital may flow there.

Consider long-term positioning. Institutional money often waits for green lights—position for adoption waves post-bill.

Finally, engage: Support advocacy groups like the Blockchain Association, which push for balanced regs.

Looking Ahead: A Long-Term Perspective on Crypto Regulation

Despite the setback, the Market Structure Bill’s delay underscores crypto’s maturation. Bipartisan talks signal eventual progress, potentially fostering a more robust ecosystem. In the interim, investors must navigate uncertainty with patience and strategy.

What if this delay sparks innovation outside traditional finance, reshaping how we view money itself?

References Used for This Article

- https://www.coindesk.com/policy/2025/12/15/senate-punts-crypto-market-structure-bill-to-next-year

- https://www.coindesk.com/policy/2025/12/20/state-of-crypto-trying-to-figure-out-the-market-structure-bill-s-prognosis

- https://cointelegraph.com/news/us-crypto-market-structure-legislation-delayed-until-2026

- https://coinpedia.org/news/us-crypto-market-structure-bill-delayed-until-2026/

- https://www.tradingview.com/news/coinpedia:3779e4f95094b:0-us-crypto-market-structure-bill-delayed-until-2026/

- https://economictimes.indiatimes.com/news/international/us/crypto-market-structure-bill-stalls-as-senate-banking-committee-pushes-vote-to-2026-heres-whats-happening/articleshow/125992516.cms?from=mdr

- https://bitcoinethereumnews.com/bitcoin/us-senate-delays-crypto-market-structure-markup-to-2026-amid-bipartisan-talks-bitcoin-drops-5k/

- https://www.bitrue.com/blog/crypto-bill-congress-2026-comprehensive-regulation

- https://punchbowl.news/article/vault/defi-crypto-congress/

- https://www.youtube.com/watch?v=phCziDqnykM

(Note: This is not financial advice. Crypto is volatile; always DYOR and only invest what you can afford to lose.)

[…] should stay informed. Monitor upcoming rulemakings from the CFTC and SEC, particularly on market structure bills stalled in the Senate. Use tools like IRS guidance to track transactions accurately—software […]