US crypto regulation emerged as a cornerstone of financial policy, transforming a once-fragmented landscape into a more structured ecosystem.

US Crypto Regulation 2025: GENIUS Act, Tax Reforms, and How They Reshaped the Market

In 2025, US crypto regulation emerged as a cornerstone of financial policy, transforming a once-fragmented landscape into a more structured ecosystem. This shift, driven by landmark legislation and updated tax guidelines, addressed long-standing uncertainties. Investors and institutions alike navigated these changes, witnessing how clearer rules fostered innovation while imposing necessary safeguards. As the year closes, it’s clear that US crypto regulation has set the stage for sustainable growth in digital assets.

Michael Saylor Calls for Urgent U.S. Crypto Asset Classification …

Alt: Illustration of US crypto regulation framework in 2025

The GENIUS Act: A Foundation for Stablecoin Oversight

The Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, signed into law on July 18, 2025, by President Trump, marked a pivotal moment in US crypto regulation. This legislation created the first federal regulatory framework specifically for payment stablecoins—digital assets redeemable for a fixed value, like the US dollar.

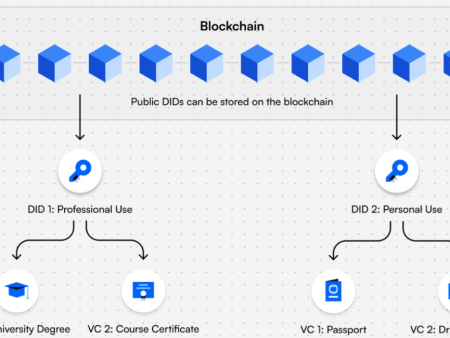

Think of stablecoins as the steady anchors in the volatile sea of cryptocurrencies. Before the GENIUS Act, they operated in a regulatory gray area, relying on state-level money transmitter licenses or ad-hoc federal guidance. The Act changed that by preempting certain state laws and establishing uniform national standards. It ensures issuers maintain reserves, undergo audits, and adhere to redemption rules, building trust in these assets.

Expanding the CFTC’s Role in US Crypto Regulation

One key provision expanded the Commodity Futures Trading Commission’s (CFTC) authority over stablecoins and related markets. The CFTC, traditionally overseeing commodities like oil and gold, now regulates spot cryptocurrency products for the first time. This move clarified jurisdictional overlaps with the Securities and Exchange Commission (SEC), reducing the “regulation by enforcement” approach that plagued the industry for years.

For instance, the Act allows for listed spot crypto products to trade on federally regulated exchanges, a step that integrates digital assets into mainstream finance. However, implementation deadlines loom: Regulators must finalize rules by July 18, 2026. This expansion reflects a broader trend in US crypto regulation toward treating most cryptos as commodities rather than securities.

Enabling Banks to Issue Stablecoins

Another breakthrough: The GENIUS Act permits federally chartered banks and credit unions to issue stablecoins, provided they meet strict capital and reserve requirements. This opens the door for traditional financial institutions to enter the crypto space, potentially bridging fiat and digital worlds.

Critics, however, argue the Act’s restrictions on foreign-issued stablecoins could limit competition. Still, it represents a balanced approach, prioritizing stability without stifling growth.

Crypto Tax Laws 2025: Reporting Reforms and Implications

Parallel to the GENIUS Act, US crypto regulation in 2025 saw significant tax updates from the Internal Revenue Service (IRS). Starting January 1, 2025, digital asset brokers—like exchanges—must report gross proceeds from sales and exchanges on the new Form 1099-DA. This aims to close compliance gaps, ensuring taxpayers accurately report crypto transactions.

Crypto tax rates remained consistent: Short-term capital gains (held under a year) are taxed at ordinary income rates of 10% to 37%, while long-term gains range from 0% to 20%, depending on income. The annual gift tax exclusion rose to $19,000 per recipient, offering a way to transfer assets tax-free within limits.

Bipartisan Efforts on Staking and DeFi Taxation

While not as headline-grabbing as the GENIUS Act, bipartisan discussions in Congress pushed for clearer tax treatment of staking rewards—earnings from validating blockchain transactions. Although full exemptions didn’t materialize, proposed reforms sought to defer taxes on staking until rewards are sold, treating them like unrealized gains in traditional investments. This reflects ongoing efforts to adapt crypto tax laws 2025 to innovative activities, reducing the burden on participants in decentralized finance (DeFi).

High-income earners face additional scrutiny, with potential Net Investment Income Tax (NIIT) at 3.8% on gains. Overall, these changes make compliance easier but underscore the need for meticulous record-keeping.

Current Trends: How US Crypto Regulation Influenced Market Dynamics

In 2025, US crypto regulation didn’t just impose rules—it catalyzed market evolution. The total cryptocurrency market cap surged, with Bitcoin approaching $100,000 by year-end, fueled by regulatory clarity. Institutional adoption accelerated, as clearer frameworks reduced risks for funds and banks.

One notable trend: The rise of tokenized real-world assets (RWAs), where traditional securities like bonds are digitized on blockchains. This aligns with the GENIUS Act’s stablecoin focus, enabling seamless settlements.

Bitcoin on track for $100,000 in 2025, historical growth guides …

Alt: Crypto market chart showing growth under US crypto regulation in 2025

Chainlink’s Oracles: Bridging Real-World Data Amid Regulatory Shifts

A prime example of adaptation is Chainlink’s oracles, which feed real-world data into smart contracts on altcoin networks. In a regulated environment, these oracles ensure compliance by providing verifiable data for DeFi applications, like insurance payouts tied to weather events.

Under 2025’s US crypto regulation, Chainlink enhanced its decentralized oracle networks to meet transparency standards, helping altcoins like Ethereum integrate with traditional finance. This not only mitigates risks but also unlocks new use cases, such as automated lending based on external market data.

Globally, similar trends emerged, with Europe’s MiCA framework influencing US policies. Yet, the US led in stablecoin innovation, with issuance volumes climbing as banks entered the fray.

A data-backed insight: According to Chainalysis, crypto adoption in North America grew 25% in 2025, attributed to regulatory progress that boosted investor confidence.

Pros, Risks, and Common Misconceptions in US Crypto Regulation

The benefits of 2025’s US crypto regulation are evident. Pros include enhanced consumer protection through reserve requirements and audits, reducing the likelihood of collapses like FTX. It also attracts institutional capital, as seen in the approval of spot crypto ETFs. Moreover, clearer rules foster innovation, allowing projects to focus on development rather than legal battles.

However, risks persist. Compliance costs could burden smaller players, potentially consolidating power among big institutions. Overly restrictive measures, like limits on foreign stablecoins, might stifle global competition. Additionally, evolving tax reporting demands increase administrative hurdles for retail investors.

Common misconceptions abound. Many assume regulation spells the end of crypto’s decentralization ethos. In reality, it’s more like installing guardrails on a highway—speed limits exist, but the road remains open. Another myth: All cryptos are now securities. The GENIUS Act and related bills clarify distinctions, treating most as commodities.

Actionable Insights for Investors and Stakeholders

As US crypto regulation solidifies, readers should stay informed. Monitor upcoming rulemakings from the CFTC and SEC, particularly on market structure bills stalled in the Senate. Use tools like IRS guidance to track transactions accurately—software like Koinly can automate this.

Diversify holdings across regulated assets, such as USD-backed stablecoins, to mitigate volatility. For DeFi enthusiasts, prioritize platforms using compliant oracles like Chainlink’s to ensure data integrity.

Watch for bipartisan tax reforms on staking; if enacted, they could defer taxes, improving returns. Finally, engage with policymakers—industry feedback shapes future policies.

Conclusion: A Long-Term View on Crypto’s Regulated Future

2025 proved transformative for US crypto regulation, with the GENIUS Act and tax reforms reshaping the market into a more mature arena. These changes, while challenging, pave the way for broader adoption and stability. Looking ahead, the integration of digital assets into everyday finance seems inevitable.

But what if regulation evolves too slowly—will the US risk falling behind global innovators in the next decade?

Top Ten References Used for This Article

- Congress.gov – S.1582 – GENIUS Act – 119th Congress (2025-2026): https://www.congress.gov/bill/119th-congress/senate-bill/1582

- Whitehouse.gov – Fact Sheet: President Donald J. Trump Signs GENIUS Act into Law: https://www.whitehouse.gov/fact-sheets/2025/07/fact-sheet-president-donald-j-trump-signs-genius-act-into-law/

- Chainalysis.com – 2025 Crypto Regulatory Round-Up: What Changed and What’s Ahead: https://www.chainalysis.com/blog/2025-crypto-regulatory-round-up/

- JAMSADR.com – How the GENIUS Act Is Reshaping Stablecoin Regulation: https://www.jamsadr.com/insight/2025/how-the-genius-act-is-reshaping-stablecoin-regulation-and-emerging

- Americanprogress.org – Congress Must Place Guardrails Around Crypto Markets: https://www.americanprogress.org/article/congress-must-place-guardrails-around-crypto-markets/

- SSGA.com – GENIUS Act explained: What it means for crypto and digital assets: https://www.ssga.com/us/en/intermediary/insights/genius-act-explained-what-it-means-for-crypto-and-digital-assets

- Consumerfinancialserviceslawmonitor.com – NCUA Moves GENIUS Act Rulemaking to OMB: https://www.consumerfinancialserviceslawmonitor.com/2025/12/ncua-moves-genius-act-rulemaking-to-omb-kicking-off-implementation-process/

- Financialservices.house.gov – The Clock Is Ticking on Crypto Market Structure Legislation in the U.S.: https://financialservices.house.gov/news/documentsingle.aspx?DocumentID=410871

- Mayerbrown.com – Understanding When and How the GENIUS Act Preempts State Law: https://www.mayerbrown.com/en/insights/events/2025/11/understanding-when-and-how-the-genius-act-preempts-state-law

- Klgates.com – The GENIUS Act and Stablecoins: Could This Replace State Money Transmitter Licensing: https://www.klgates.com/The-GENIUS-Act-and-Stablecoins-Could-This-Replace-State-Money-Transmitter-Licensing-10-6-2025

(Note: This is not financial advice. Crypto is volatile; always DYOR and only invest what you can afford to lose.)