The Market Structure Bill, represents a pivotal shift in how the U.S. regulates digital assets.

Market Structure Bill Breakdown: How It Splits Oversight Between SEC and CFTC – And Why That Matters

2024-25 Crypto Regulation Guide | Nasdaq

The Market Structure Bill, formally known as the Financial Innovation and Technology for the 21st Century Act (FIT21), represents a pivotal shift in how the U.S. regulates digital assets. Passed by the House in 2024 and under Senate consideration in 2025, this legislation aims to clarify the blurry lines between securities and commodities in the crypto space. For investors navigating volatile markets, understanding its implications is essential—especially as crypto adoption surges globally.

Why the Market Structure Bill Is Gaining Traction Now

Crypto has evolved from a niche experiment to a trillion-dollar industry. Yet, regulatory uncertainty has stifled growth. Enter the Market Structure Bill. Introduced amid high-profile scandals like FTX’s collapse, it seeks to provide clarity without over-regulating innovation. With Bitcoin’s price fluctuating wildly—dropping from $126,000 in October 2025 to below $86,000 in November—the bill’s timing couldn’t be more relevant.

Lawmakers from both parties recognize the need. The bill passed the House with bipartisan support, signaling a rare consensus in Washington. As Senate versions, like the CLARITY Act, emerge, discussions intensify. This isn’t just policy wonkery; it’s about positioning the U.S. as a leader in fintech rather than letting talent flee overseas.

Moreover, global crypto users topped 560 million in 2024, projected to hit 861 million by 2025. That’s roughly 10% of the world’s population. Investors are watching closely, as clearer rules could unlock institutional capital.

Breaking Down Key Provisions of the Market Structure Bill

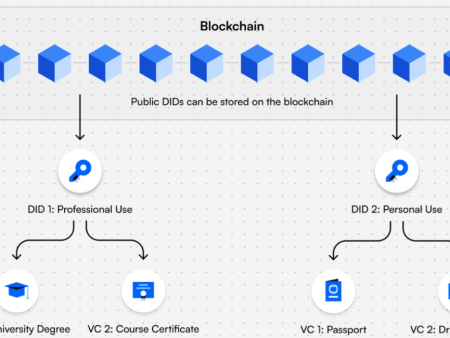

At its core, the Market Structure Bill divides oversight between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Think of it like splitting chores: the SEC handles investment-like assets, while the CFTC oversees commodity-style trading.

First, definitions matter. The bill classifies digital assets as either “restricted digital assets” (securities under SEC jurisdiction) or “digital commodities” (non-securities regulated by the CFTC). A key test: if an asset is tied to a decentralized network, it leans commodity. For example, Bitcoin is already treated as a commodity by the CFTC, but Ethereum’s status has been debated.

The CFTC gets an expanded role in spot markets—the day-to-day buying and selling of crypto. Previously, its oversight was limited to futures. Now, it would regulate spot exchanges for digital commodities, imposing requirements like customer fund segregation and anti-manipulation rules. This mirrors how it oversees gold or oil markets.

Meanwhile, the SEC retains control over assets deemed securities, applying the Howey Test: if it’s an investment expecting profits from others’ efforts, it’s a security. But the bill offers a pathway out. Decentralized networks can self-certify their status, potentially shifting oversight to the CFTC after a review period. This “off-ramp” encourages true decentralization, reducing SEC scrutiny for projects that prove they’re not centralized entities.

Joint rulemakings ensure the agencies collaborate on overlapping issues, like stablecoins. Permitted payment stablecoins get special treatment, exempt from some securities rules if they meet stability criteria.

SEC and CFTC Regulations on Cryptocurrencies Statistics 2025 • CoinLaw

Current Trends: How the Market Structure Bill Fits into 2025’s Crypto Landscape

As 2025 wraps up, crypto markets show resilience despite volatility. The global market cap exceeded $3 trillion in November 2024, with Bitcoin alone at $2 trillion by January 2025. Ethereum follows at $438 billion, underscoring the dominance of top assets.

Regulatory progress is accelerating. The Senate Banking Committee released a draft in August 2025, building on FIT21. Meanwhile, Europe’s MiCA framework is live, pressuring the U.S. to catch up. Real-world examples abound: Chainlink’s oracles, which feed real-world data to smart contracts, could benefit from clearer commodity status, enabling more altcoin integrations without SEC hurdles.

Adoption trends reveal a maturing market. In the U.S., 65.7 million people own crypto in 2025, up significantly. Asia leads with the most owners, while North America saw $1.3 trillion in transactions from July 2023 to June 2024. Stablecoins dominate trading, accounting for over 60% of volume—highlighting the need for the bill’s stablecoin provisions.

Yet, enforcement actions persist. The SEC’s lawsuits against exchanges like Coinbase underscore the current patchwork approach. The Market Structure Bill could streamline this, fostering innovation in DeFi and NFTs.

Crypto market cap 2010-2025| Statista

Pros, Risks, and Misconceptions Surrounding the Market Structure Bill

Proponents hail the Market Structure Bill as a win for clarity. By assigning the CFTC—seen as more crypto-friendly—to commodities, it could reduce litigation and attract investment. For instance, venture funding in crypto dipped amid uncertainty; clearer rules might reverse that. Consumer protections, like mandatory disclosures, add safeguards without killing growth.

Critics, however, warn of risks. Some argue it weakens investor protections by shifting assets from the SEC’s rigorous regime to the CFTC’s lighter touch. The CLARITY Act, a follow-up, has been called “worse than FIT21” for potentially deregulating too much. There’s also the danger of regulatory arbitrage, where projects game the system to avoid oversight.

Common misconceptions abound. One: the bill legalizes all crypto. No—it regulates, not endorses. Another: it favors big players. Actually, the decentralization pathway helps smaller, truly distributed projects. Finally, don’t assume passage is guaranteed; Senate hurdles remain in 2025.

Actionable Insights for Investors in Light of the Market Structure Bill

Stay informed: Monitor Senate progress on the Market Structure Bill via sources like Congress.gov. If passed, reassess portfolios—commodity-status assets might see liquidity boosts.

Diversify thoughtfully. With Bitcoin at 50%+ market dominance, consider altcoins like Ethereum or Solana, which could thrive under CFTC rules. Use tools like Chainlink for data-driven decisions in smart contracts.

Watch metrics: Track adoption rates—14% of non-owners plan to buy in 2025. Engage with compliant platforms to mitigate risks.

Finally, think long-term. Regulatory clarity could propel the market, but volatility persists. Position accordingly.

A Long-Term View on Crypto Regulation

The Market Structure Bill isn’t a panacea, but it lays groundwork for sustainable growth. By balancing oversight, it could help crypto integrate into mainstream finance, much like the internet did post-dot-com bust. As the industry matures, expect more refinements.

What if this bill sparks a new era of innovation—will you be ready to capitalize?

References Used for This Article

- House Committee on Agriculture – FIT for the 21st Century Act Section by Section: https://agriculture.house.gov/uploadedfiles/market_structure_bill_section_by_section.pdf

- Congress.gov – H.R.4763: https://www.congress.gov/bill/118th-congress/house-bill/4763/text/ih

- Thomson Reuters – The future of crypto-regulation: What is FIT 21?: https://www.thomsonreuters.com/en-us/posts/government/crypto-regulation-fit-21/

- Mayer Brown – House Passes Digital Asset Market Structure Legislation: https://www.mayerbrown.com/en/insights/publications/2024/06/house-passes-digital-asset-market-structure-legislation-financial-innovation-and-technology-for-the-21st-century-act-fit21

- Paul Hastings – The Financial Innovation and Technology for the 21st Century Act: https://www.paulhastings.com/insights/crypto-policy-tracker/the-financial-innovation-and-technology-for-the-21st-century-act-a-template-for-future-crypto-market-legislation

- CoinDesk – State of Crypto: Trying to figure out the market structure bill’s prognosis: https://www.coindesk.com/policy/2025/12/20/state-of-crypto-trying-to-figure-out-the-market-structure-bill-s-prognosis

- Arnold & Porter – Clarifying the CLARITY Act: https://www.arnoldporter.com/en/perspectives/advisories/2025/08/clarifying-the-clarity-act

- Chainalysis – 2025 Crypto Regulatory Round-Up: https://www.chainalysis.com/blog/2025-crypto-regulatory-round-up/

- Awisee – Cryptocurrency Statistics In 2025: https://awisee.com/blog/cryptocurrency-statistics/

- Security.org – 2025 Cryptocurrency Adoption and Consumer Sentiment Report: https://www.security.org/digital-security/cryptocurrency-annual-consumer-report/

Note: This is not financial advice. Crypto is volatile; always DYOR and only invest what you can afford to lose.