As Bitcoin prices hovered below $90,000 in December 2025, a surprising trend emerged: institutional buyers are accumulating

Bitcoin in 2025: Why Institutional Buyers Are Accumulating Despite the Price Dip

As Bitcoin prices hovered below $90,000 in December 2025, a surprising trend emerged: institutional buyers are accumulating vast amounts of the cryptocurrency. Companies like Metaplanet pushed their holdings to 20,000 BTC, while broader Digital Asset Treasuries (DATs) signaled unwavering confidence. This movement contrasts sharply with retail caution, highlighting a shift in market dynamics. But why are these heavyweights doubling down now? In a year marked by volatility, this accumulation underscores Bitcoin’s evolving role as a strategic asset.

Bitcoin Q1 2025: Historic Highs, Volatility, and Institutional Moves

Alt: Institutional Buyers Are Accumulating Bitcoin in 2025 Chart

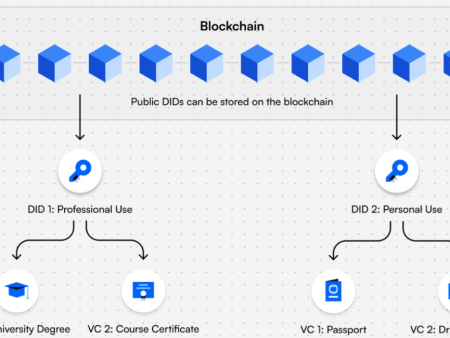

Understanding Digital Asset Treasuries

Digital Asset Treasuries, or DATs, represent a modern approach to corporate finance. Essentially, these are reserves where companies hold cryptocurrencies like Bitcoin instead of traditional assets such as cash or bonds. Think of it like a company swapping its rainy-day fund for gold bars—but in this case, the “gold” is digital and operates on a blockchain.

The concept gained traction in the early 2020s with pioneers like MicroStrategy. By 2025, over 200 companies have adopted DAT strategies, collectively holding more than 1 million BTC. This isn’t speculative gambling; it’s a calculated bet on Bitcoin’s scarcity and potential as an inflation hedge. For instance, with Bitcoin’s fixed supply of 21 million coins, DATs position firms to benefit from long-term appreciation.

Yet, DATs go beyond mere holding. They often involve sophisticated strategies, such as borrowing against Bitcoin to fund operations without selling. This allows companies to maintain exposure while generating yield. However, it’s not without complexity—regulatory scrutiny has increased, as DATs blur lines between investment and treasury management.

Current Trends: Institutional Buyers Are Accumulating Amid the Dip

December 2025 painted a clear picture of divergence in the market. Bitcoin’s price, after touching an all-time high of over $93,000 earlier in the month, settled into a range between $85,000 and $90,000. Daily closes showed fluctuations: on December 19, it dipped to around $85,509, rebounding slightly to $88,131 by December 20, and stabilizing near $87,850 by December 28. Retail investors, wary of volatility, pulled back—evidenced by outflows from spot Bitcoin ETFs totaling nearly $3.8 billion in November, though inflows resumed modestly in early December.

In contrast, institutional buyers are accumulating with conviction. Metaplanet, a Japanese investment firm, exemplifies this. By December 22, they had expanded their Bitcoin treasury to 20,000 BTC, making them Japan’s largest holder. Just days later, on December 25, their board approved an ambitious plan to target 210,000 BTC by 2027, even as prices lingered at $87,400. This wasn’t isolated; the broader DAT ecosystem saw nearly 200 public companies acquire roughly additional Bitcoin throughout the year, pushing aggregate holdings well over $100 billion.

Why now? Favorable macro conditions play a role. The U.S. Federal Reserve’s shift away from quantitative tightening in late 2025 injected liquidity, making risk assets like Bitcoin more appealing. Additionally, institutional tools have matured—ETFs, custody solutions, and derivatives enable safer entry. Data from BitcoinTreasuries.NET shows institutional holdings now exceed 10% of Bitcoin’s supply, a milestone reflecting sustained demand.

To visualize this price dip against accumulation, consider the following chart of Bitcoin’s December 2025 performance:

This line chart, sourced from historical data, illustrates the consolidation below $90,000 while institutions ramped up purchases.

Metaplanet Increases Bitcoin Holdings to 5,000 BTC, Valued at …

Alt: Institutional Buyers Are Accumulating at Metaplanet Bitcoin Holdings

The Pros of Institutional Accumulation

Institutional buyers are accumulating for compelling reasons. First, Bitcoin serves as a hedge against fiat depreciation. With global inflation persisting in 2025, holding a deflationary asset like Bitcoin preserves value. MicroStrategy, holding approximately 671,268 BTC as of December 2024, has seen its stock outperform Bitcoin itself through leveraged strategies.

Second, yield generation is a draw. Companies can collateralize Bitcoin for low-interest loans, funding growth without dilution. Metaplanet’s approach—using share issuances to buy more BTC—demonstrates this, turning equity into crypto exposure. For fintech firms, DATs integrate seamlessly with operations, enhancing efficiency.

Finally, regulatory clarity in 2025, including ETF approvals and clearer guidelines, has reduced barriers. This influx stabilizes the market, reducing volatility over time—as seen in Bitcoin’s 90-day realized volatility halving to about 25% in early December.

Risks and Common Misconceptions

Of course, risks abound. Price volatility remains a core challenge; Bitcoin’s December dip erased gains for late entrants. Institutional buyers are accumulating, but a prolonged bear phase could strain balance sheets, especially for leveraged positions. The 2025 crash, where $19 billion in positions vanished, serves as a reminder.

Regulatory risks loom too. DATs have drawn scrutiny for potentially misleading investors about crypto’s stability. Misconceptions include viewing DATs as “easy money”—they require robust risk management, not hype.

Another myth: Institutions signal the end of retail’s role. In reality, they complement it, providing liquidity that benefits all. However, over-reliance on institutional flows could amplify sell-offs if sentiment shifts.

Actionable Insights for Investors

For curious investors, track DAT announcements closely. Tools like BitcoinTreasuries.NET offer real-time holdings data. Watch MicroStrategy and Metaplanet filings for patterns.

Consider exposure via ETFs for lower risk—BlackRock’s IBIT saw $125.6 million inflows on December 3 alone. Diversify; don’t chase dips blindly.

Stay informed on macro cues, like Fed policies. If liquidity eases further, expect more accumulation.

Finally, assess your horizon. Institutional buyers are accumulating for years, not weeks—align accordingly.

To boost engagement, here’s an embedded TradingView chart for real-time Bitcoin USD tracking: TradingView BTCUSD Chart.

Looking Ahead: A Long-Term Perspective

As 2025 closes, institutional buyers are accumulating Bitcoin despite short-term dips, betting on its scarcity and utility. This trend, fueled by DATs, positions crypto as a mainstream asset class. While retail hesitates, these moves could pave the way for broader adoption.

What if this accumulation sparks the next bull cycle—will you be positioned to benefit?

References Used for This Article

- Analytics | Bitcoin Holdings & Financial Insights | Metaplanet – https://metaplanet.jp/en/analytics

- Crypto News Today: Latest Updates for 25 Dec 2025, Bitcoin Hovers … – https://finance.yahoo.com/news/crypto-news-today-latest-updates-113037464.html

- Metaplanet board approves plan to buy more Bitcoin – DL News – https://www.dlnews.com/articles/markets/metaplanet-board-approves-bitcoin-buying-plan/

- Metaplanet’s Bitcoin Holdings Reach 20,000 BTC After 11.5M Share … – https://www.blockchain-council.org/bitcoin/metaplanets-bitcoin-holdings-20000-btc/

- BitcoinTreasuries.NET – Top Bitcoin Treasury Companies – https://bitcointreasuries.net/

- 2026 Digital Asset Outlook: Dawn of the Institutional Era | Grayscale – https://research.grayscale.com/reports/2026-digital-asset-outlook-dawn-of-the-institutional-era

- Key capital market trends: Digital asset treasuries – Market Edge – https://marketedge.dlapiper.com/2025/10/key-capital-market-trends-digital-asset-treasuries/

- Bitcoin USD (BTC-USD) Price History & Historical Data – Yahoo … – https://finance.yahoo.com/quote/BTC-USD/history/

- Bitcoin Historical Data – Investing.com – https://www.investing.com/crypto/bitcoin/historical-data

- BTC USD — Bitcoin Price and Chart — TradingView – https://tradingview.com/chart/BTCUSD/

(Note: This is not financial advice. Crypto is volatile; always DYOR and only invest what you can afford to lose.)