Michael Selig Sworn In as CFTC Chair: What It Means for XRP’s Commodity Status and 2026 Rally

Michael Selig Sworn In as CFTC Chair: What It Means for XRP’s Commodity Status and 2026 Rally

Michael Selig’s swearing-in as CFTC Chair brings fresh focus to XRP’s commodity status. This development arrives amid ongoing debates over crypto oversight. Investors seek resolution to regulatory uncertainties that have shadowed XRP for years.

The event underscores a shifting landscape. With Selig at the helm, harmony between the CFTC and SEC could emerge. This might clarify XRP’s position and fuel market optimism.

Why does this matter now? Crypto markets remain volatile. Clear rules could unlock institutional capital. For XRP, it means potential growth beyond current hurdles.

Regulatory clarity often drives rallies. Past examples show how resolved disputes boost prices. XRP holders watch closely for signs of a 2026 surge.

A Breakdown of the Crypto-Currency Act of 2020 – Sarson Funds

Who Is Michael Selig? A Deep Dive into His Background

Michael Selig took the oath as the 16th CFTC Chairman on December 22, 2025. His confirmation by the Senate came just days earlier.

Before this role, Selig built a robust career in finance law. He served as a partner at Willkie Farr & Gallagher from 2022 to 2025. There, he advised on derivatives and digital assets.

Earlier, Selig held key positions in government. He acted as chief counsel for the SEC’s Crypto Task Force. This experience shaped his views on crypto regulation.

Selig also worked closely with former SEC Chairman Paul Atkins. His expertise bridges securities and commodities laws. This dual perspective is vital.

In private practice, he represented futures merchants. He guided crypto firms through complex rules. Such hands-on work informs his leadership.

Selig has voiced support for innovation. He criticizes “regulation by enforcement.” Instead, he favors clear guidelines.

He pledged a comprehensive crypto framework by Q1 2026. This timeline signals urgency. It aims to harmonize CFTC and SEC approaches.

For XRP, this pledge holds promise. Lingering SEC disputes could resolve. Selig’s background suggests a balanced path forward.

His pro-crypto stance draws attention. Industry leaders welcome his appointment.

Key Concepts: Explaining XRP’s Commodity Status in Plain English

XRP powers the Ripple network. It enables fast, low-cost payments across borders.

The core issue: Is XRP a security or a commodity? Securities fall under SEC jurisdiction. Commodities belong to the CFTC.

Bitcoin and Ether are deemed commodities. They avoid strict SEC rules. XRP’s status remains debated.

In 2023, a court ruled XRP not a security for secondary sales. Yet, appeals persist.

This creates regulatory overhang. It deters investors and stifles adoption.

Selig’s framework could classify XRP as a commodity. That shifts oversight to the CFTC. Less stringent rules might follow.

Think of it as a traffic light. Red means stop due to uncertainty. Green signals go for growth.

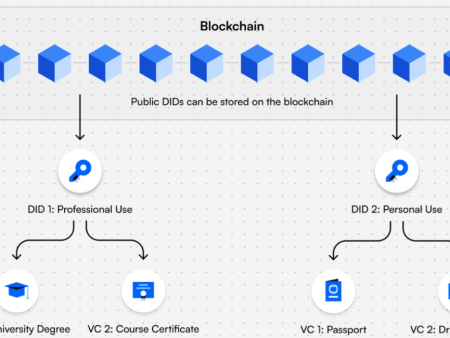

Meanwhile, Chainlink’s oracles play a related role. They bridge blockchains to real-world data.

Smart contracts are self-executing code. But they can’t access external info alone.

Oracles solve this. They fetch data like prices or weather. Chainlink provides decentralized oracles.

This enables altcoin smart contracts. For example, DeFi apps use oracles for loans.

Like a trusted messenger, oracles ensure accuracy. Without them, contracts stay isolated.

For XRP, commodity status clarity boosts utility. It integrates better with oracle-fed systems.

Regulatory harmony aids this. CFTC-SEC alignment reduces overlaps.

Chainlink’s Oracles: Enabling Real-World Data for Altcoin Smart Contracts

Chainlink stands out in the oracle space. Its network connects blockchains to off-chain data.

Decentralization is key. Multiple nodes verify data. This prevents single-point failures.

Real-world applications abound. Insurance contracts use weather data via oracles.

In finance, price feeds drive trading. Chainlink supplies accurate crypto prices.

Altcoins benefit greatly. They build complex dApps needing external inputs.

For instance, prediction markets rely on oracles. They settle bets on real events.

Chainlink’s Cross-Chain Interoperability Protocol expands reach. It links different blockchains.

Security matters. Oracles must resist manipulation. Chainlink uses staking for accountability.

Adoption grows. Major projects integrate Chainlink. This enhances altcoin ecosystems.

Regulatory clarity supports this. Clear rules encourage oracle use in compliant ways.

XRP could leverage oracles more. Cross-border payments need real-time forex data.

Thus, oracles like Chainlink’s enable practical altcoin functions.

The Year in Chainlink 2021 | Chainlink Blog

This infographic illustrates Chainlink’s oracle network. It shows data flow to smart contracts.

Current Trends: Regulatory Harmony and Crypto Relevance

CFTC-SEC harmony gains traction. In September 2025, they issued a joint statement.

They hosted a roundtable on harmonization. Discussions focused on digital assets.

The CLARITY Act advances. Markup is scheduled for January 2026.

This bill defines asset classes. It assigns oversight clearly.

For XRP’s commodity status, it’s pivotal. Ripple holds significant supply. Thresholds in the act matter.

Broader trends include tokenization. Real assets go on-chain.

Chainlink’s oracles facilitate this. They provide verifiable data for tokenized bonds.

DeFi expands. Oracle integration drives growth.

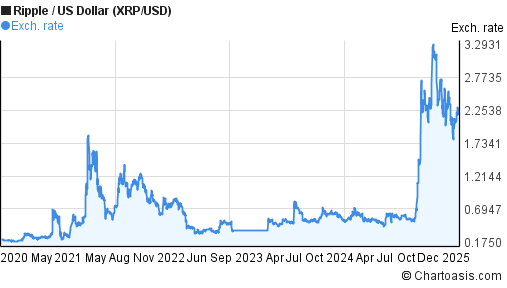

XRP’s price hovers at $1.88 as of December 23, 2025. Market cap exceeds $100 billion.

A data-backed insight: Over five years, XRP’s value increased 322%. This shows resilience despite volatility.

Year-to-date, it dipped 9.45%. Yet, institutional interest rises.

Crypto integrates with fintech. Payment firms adopt XRP for remittances.

Regulatory progress accelerates this. Harmony reduces enforcement risks.

Altcoins like Chainlink thrive. Oracles power hybrid finance.

Watch for Q1 2026 developments. Selig’s framework could redefine markets.

5 years XRP price chart. Ripple/USD graph

View this five-year XRP price chart. It highlights key peaks and trends.

For interactive analysis, check the TradingView XRP/USD chart: https://www.tradingview.com/symbols/XRPUSD/

Pros, Risks, and Misconceptions Surrounding XRP’s Commodity Status

Pros start with clarity. Defined commodity status lifts overhang.

Institutions enter freely. Adoption in payments surges.

A 2026 rally appears likely. Analysts predict prices above $15.

Chainlink’s oracles exemplify benefits. They make altcoins viable for real use.

Harmony streamlines compliance. Firms avoid dual regulations.

Risks include delays. Legislation might stall in Congress.

Volatility persists. XRP fell 50% from its 2025 peak.

Global factors matter. International rules could conflict.

A common misconception: Clarity equals instant gains. Markets react unpredictably.

Another myth: XRP ties solely to Ripple. It’s a decentralized asset.

Oracles aren’t foolproof. Data manipulation risks exist, though mitigated.

Harmony doesn’t eliminate oversight. Stronger rules may emerge.

Overall, pros dominate for patient investors. But assess risks carefully.

SEC and CFTC Regulations on Cryptocurrencies Statistics 2025 • CoinLaw

This infographic breaks down SEC and CFTC roles in crypto regulation.

Actionable Insights: Navigating XRP’s Commodity Status Shift

Track the CLARITY Act closely. Its January markup could clarify XRP’s commodity status.

Follow Selig’s speeches. Q1 2026 framework details will emerge.

Diversify holdings. Include altcoins like Chainlink for oracle exposure.

Explore Chainlink’s use cases. Study how oracles enhance smart contracts.

Monitor XRP charts. Use TradingView for technical analysis: https://www.tradingview.com/symbols/XRPUSD/

Consider long positions if clarity nears. Avoid knee-jerk reactions.

Join industry forums. Discuss harmony impacts with peers.

Read official updates. CFTC and SEC sites provide reliable info.

Think about real-world integration. Oracles bridge gaps for altcoins.

Stay updated on predictions. Analysts forecast XRP at $8 by 2026.

Act strategically. Regulation shapes opportunities.

Conclusion: A Long-Term View on Crypto Evolution

Selig’s leadership heralds change. CFTC-SEC harmony could resolve key issues.

For XRP’s commodity status, the fog lifts. Overhang fades over time.

Chainlink’s oracles highlight innovation. They connect altcoins to reality.

Markets reward clarity. Patience pays in crypto.

A 2026 rally beckons. Fundamentals drive sustainable growth.

What if XRP’s commodity status unlocks a new era of adoption—could it redefine global payments?

Sources

- https://www.cftc.gov/PressRoom/PressReleases/9164-25

- https://www.linkedin.com/in/michaelselig

- https://www.wilmerhale.com/en/insights/client-alerts/20251218-michael-selig-confirmed-as-cftc-chairman—six-issues-to-watch-in-2026

- https://www.willkie.com/news/2025/12/willkie-alum-michael-selig-confirmed-as-16th-cftc-chairmano

- https://www.planadviser.com/senate-approves-michael-selig-to-head-cftc/

- https://www.gemini.com/cryptopedia/what-is-chainlink-and-how-does-it-work

- https://finance.yahoo.com/quote/XRP-USD/history/

- https://www.investing.com/crypto/xrp/historical-data

- https://coinmarketcap.com/currencies/xrp/historical-data/

- https://www.tradingview.com/symbols/XRPUSD/

(Note: This is not financial advice. Crypto is volatile; always DYOR and only invest what you can afford to lose.)