Institutional XRP Boom Incoming? Selig’s CFTC Leadership and Recent Collateral Approvals Explained

Institutional XRP Boom Incoming? Selig’s CFTC Leadership and Recent Collateral Approvals Explained

The institutional XRP boom may be closer than many realize. As 2025 draws to a close, recent developments in regulatory approvals and leadership changes are positioning XRP for greater integration into mainstream finance. Michael Selig’s recent swearing-in as CFTC Chairman, combined with approvals for XRP as margin collateral on platforms like Bitnomial, signals a shift. These moves could accelerate adoption among institutions seeking efficient, low-cost cross-border solutions. But what does this mean for the broader market? Let’s explore.

XRP Falls Amidst Institutional Demand, Retail Selloff

The Hook: Why the Institutional XRP Boom Matters Today

XRP, the digital asset native to the Ripple Ledger, has long been touted for its speed and efficiency in payments. Yet, regulatory hurdles have kept it on the sidelines for many institutional players. That narrative is changing rapidly. In December 2025, Bitnomial became the first CFTC-regulated exchange to accept XRP as margin collateral, treating it on par with traditional assets like Treasuries. This isn’t just a technical tweak—it’s a gateway for hedge funds, banks, and other big players to leverage XRP in derivatives trading.

Meanwhile, Michael Selig’s appointment as CFTC Chairman adds fuel to the fire. Sworn in on December 22, 2025, Selig has a history of pro-crypto views, famously stating that “XRP itself is not a security—it’s just code, like gold or whiskey.” Under his leadership, the CFTC is prioritizing blockchain innovation, including harmonization with the SEC and initiatives like the Crypto Sprint. For investors, this convergence of events suggests the institutional XRP boom could drive real utility, not just speculation.

Consider the broader context. Crypto markets have matured, with institutional inflows hitting new highs. XRP ETFs alone have surpassed $1 billion in inflows by mid-December 2025, outpacing even Bitcoin in some metrics. This data-backed insight underscores a trend: institutions are diversifying beyond BTC and ETH, eyeing assets like XRP for their practical applications in finance.

Key Concepts Explained: XRP, Margin Collateral, and CFTC Oversight

To grasp the potential institutional XRP boom, start with the basics. XRP is a cryptocurrency designed for fast, cheap transactions. Unlike Bitcoin, which focuses on store-of-value, XRP powers the Ripple network for cross-border payments. Think of it as the oil in a global financial engine—lubricating transfers that once took days and cost fortunes.

Now, margin collateral. In trading, this is the asset you post to secure a position in futures or options. Traditionally, it’s cash, bonds, or commodities. Bitnomial’s approval allows XRP to serve this role, meaning traders can use their XRP holdings directly without converting to fiat. It’s like using your home equity as collateral for a loan, but in crypto terms. This reduces friction and could increase liquidity.

The CFTC enters the picture as the U.S. regulator for commodities and derivatives. Unlike the SEC, which oversees securities, the CFTC views many cryptos as commodities. Selig’s leadership emphasizes innovation, with priorities like 24/7 trading and perpetual derivatives for digital assets. His background at Willkie Farr & Gallagher, advising on crypto matters, positions him to bridge traditional finance and blockchain.

CFTC Announces Major Staff Changes Following Trump’s Return

Current Trends: Bitnomial Approvals and Selig’s Innovation Push

Recent trends highlight how these pieces fit together. Bitnomial, a crypto-native exchange, announced XRP and RLUSD as margin collateral in November 2025, with full CFTC approval following in December. This makes XRP “first-class” collateral, equivalent to gold or stocks for margin purposes. Institutions can now hedge positions more efficiently, potentially boosting trading volumes.

Selig’s CFTC tenure, though just beginning, aligns with this. In his confirmation hearings, he stressed regulatory clarity to foster innovation. The agency has already launched spot crypto products and joint statements with the SEC on harmonization. For XRP, this means less ambiguity—especially after Ripple’s legal wins clarifying it’s not a security.

Moreover, broader adoption is evident. Ripple secured a national trust bank charter in December 2025, anchoring XRP at around $2 amid institutional validation. X posts from influencers like @CryptoPatel echo this sentiment, calling Selig’s appointment “extremely bullish” for DeFi and markets.

To visualize XRP’s journey in 2025, here’s a chart of monthly closing prices, showing peaks in July and a year-end dip to $1.87.

Grok can make mistakes. Always check original sources.

For an interactive view, embed this TradingView chart: <iframe src=”https://www.tradingview.com/chart/?symbol=BITSTAMP%3AXRPUSD” width=”600″ height=”400″ frameborder=”0″ allowfullscreen></iframe>

Pros, Risks, and Misconceptions in the Institutional XRP Boom

The pros are compelling. An institutional XRP boom could mean faster mainstream adoption. With low fees (fractions of a cent per transaction) and settlement in seconds, XRP outpaces traditional systems like SWIFT. Institutions benefit from reduced costs and enhanced liquidity, as seen in Ripple’s partnerships with banks worldwide.

However, risks persist. Volatility remains a concern—XRP dropped 11% in 2025 despite positives. Regulatory shifts under Selig could face pushback if markets overheat. Additionally, centralization critiques linger, as Ripple holds a large XRP supply, potentially influencing prices.

Common misconceptions? Many still view XRP solely through its SEC lawsuit lens, ignoring utility. Another: that collateral approvals guarantee price surges. While they enable adoption, market forces drive value. Finally, don’t confuse XRP with Ripple—the asset is decentralized, even if the company stewards development.

Tying in Chainlink’s Oracles: Enabling Real-World Data for Altcoin Smart Contracts

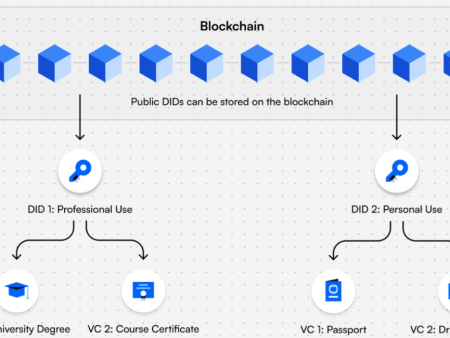

To fully appreciate the institutional XRP boom, consider complementary technologies like Chainlink’s oracles. These bridge blockchains to external data, solving the “oracle problem” where smart contracts can’t access real-world info independently. For altcoins like XRP, this means enhanced DeFi capabilities.

Chainlink provides tamper-proof data feeds, enabling smart contracts on the XRP Ledger to incorporate stock prices, weather data, or payment confirmations. Imagine an XRP-based derivative settling automatically based on real-time forex rates—Chainlink makes it possible.

What Is Chainlink? A Technical Deep Dive (Advanced) | Chainlink Blog

This integration could amplify the institutional XRP boom, as oracles unlock hybrid finance applications. For example, Chainlink’s decentralized network ensures reliability, reducing single-point failures in altcoin ecosystems.

Actionable Insights: What to Watch in the Institutional XRP Boom

For readers eyeing the institutional XRP boom, monitor CFTC rulemakings under Selig. Key areas include expanded crypto derivatives and innovation exemptions. Track institutional flows via ETF data—$1bn in XRP ETFs signals growing confidence.

Consider diversifying portfolios with XRP for payment utility, but balance with risks. Watch partnerships like Ripple’s trust charter for adoption clues. Engage with communities on X for real-time insights, as posts from @OskyMonsX highlight Selig’s pro-XRP stance.

Finally, explore tools like Chainlink for building or investing in oracle-dependent projects, enhancing altcoin strategies.

Conclusion: A Long-Term Perspective on the Institutional XRP Boom

In summary, Selig’s CFTC leadership and collateral approvals like Bitnomial’s are catalysts for an institutional XRP boom. They pave the way for seamless integration into finance, bolstered by technologies like Chainlink oracles. While challenges remain, the trajectory points to sustained growth.

What if this boom reshapes global payments entirely—will institutions lead the charge, or will retail investors drive the next wave?

References Used for This Article

- https://www.cftc.gov/PressRoom/PressReleases/9164-25

- https://bitnomial.com/news/2025-11-03/rlusd-xrp-margin-collateral/

- https://www.coindesk.com/business/2025/11/04/bitnomial-adds-rlusd-and-xrp-as-margin-collateral-expanding-crypto-derivatives-offerings

- https://www.dlnews.com/articles/markets/what-xrp-etf-1bn-haul-signals-for-price/

- https://www.cftc.gov/PressRoom/PressReleases/9145-25

- https://markets.financialcontent.com/stocks/article/marketminute-2025-12-25-institutional-validation-xrp-anchors-at-200-as-ripple-secures-historic-us-trust-bank-charter

- https://chain.link/education/blockchain-oracles

- https://chain.link/

- https://x.com/CryptoPatel/status/2001857268963512681

- https://x.com/OskyMonsX/status/2003254688498745780

(Note: This is not financial advice. Crypto is volatile; always DYOR and only invest what you can afford to lose.)

[…] XRP—over half the total 100 billion supply—into cryptographically secured escrows on the XRP Ledger. This setup releases up to 1 billion XRP monthly, providing predictability in an otherwise […]

[…] 2025 draws to a close, discussions around xrp price prediction 2025 have dominated crypto circles, especially with XRP trading in a tight […]