Less than 24 hrs to go before Ethereum’s Dencun upgrade goes live …

Ethereum 2.0 Upgrades. In the ever-evolving landscape of blockchain technology, Ethereum remains a cornerstone. As of late 2025, its ongoing upgrades continue to shape not just its own network but the broader cryptocurrency market. With institutional adoption accelerating and regulatory frameworks clarifying, these developments are drawing attention from investors seeking sustainable growth. Understanding Ethereum’s post-merge trajectory is crucial now, as it influences everything from transaction efficiency to competitive dynamics among altcoins.

The Merge in 2022 marked a pivotal shift from proof-of-work to proof-of-stake, reducing energy consumption by over 99%. But the story didn’t end there. Subsequent upgrades have built on this foundation, addressing scalability bottlenecks that once plagued the network. For curious investors and those with financial acumen, these changes offer insights into how Ethereum’s enhancements ripple through altcoin ecosystems, potentially altering market trends.

Understanding Ethereum 2.0 Upgrades in Plain Terms

Ethereum 2.0, often shorthand for the network’s multi-phase evolution, isn’t a single event but a series of iterative improvements. Think of it like upgrading a busy highway: the Merge added more lanes by changing the engine, but later phases focus on smarter traffic management.

Key post-merge upgrades include Dencun (2024), which introduced proto-danksharding to lower costs for layer-2 solutions. Pectra, activated in May 2025, enhanced account functionality, allowing everyday wallets to behave like smart contracts for easier batching and recovery. Most recently, Fusaka in December 2025 expanded data availability with PeerDAS, making nodes lighter and boosting blob capacity for cheaper layer-2 transactions.

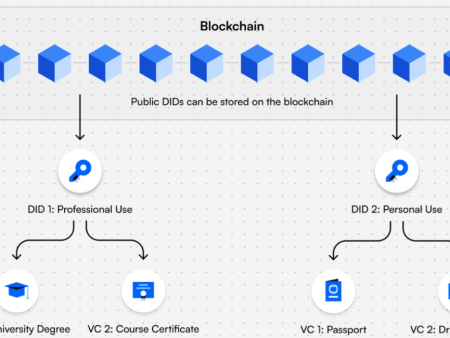

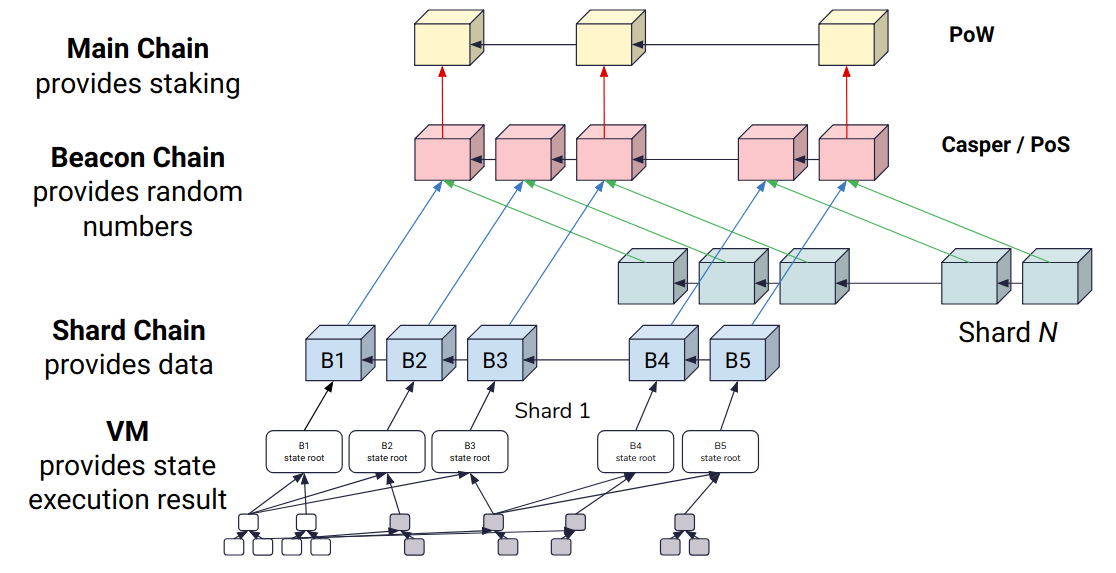

Sharding, a core promise of Ethereum 2.0, has evolved into danksharding. Instead of splitting the chain into 64 shards as initially planned, it uses blobs—temporary data packets—to scale layer-2 rollups. This analogy helps: imagine dividing a massive database into manageable chunks, but only for data storage, not execution. As a result, Ethereum can handle more transactions off the main chain without compromising security.

Eth 2: Staking, Sharding & Scaling Ethereum | Interdax Blog

These upgrades collectively aim to push Ethereum’s throughput toward 100,000 transactions per second, far beyond its current 25-35 TPS on the base layer.

Current Trends and Real-World Relevance

In 2025, Ethereum’s upgrades have tangibly impacted market dynamics. Layer-2 networks like Arbitrum and Optimism now process 63% of Ethereum transactions, according to data from CoinLaw. This shift has driven average gas fees down to $0.38, a stark contrast to pre-merge peaks. For context, mid-2025 fees hovered around $1.85, but Fusaka’s enhancements promise further reductions to under $0.01 for layer-2 swaps.

These efficiencies extend to altcoins. Ethereum’s dominance in DeFi and NFTs sets benchmarks; when its fees drop, altcoins must compete harder. XRP, focused on cross-border payments, has seen mixed effects. While Ethereum’s scalability improvements pressure XRP’s niche, they also foster interoperability. For instance, bridges between Ethereum and Ripple’s ledger have grown, enabling seamless asset transfers.

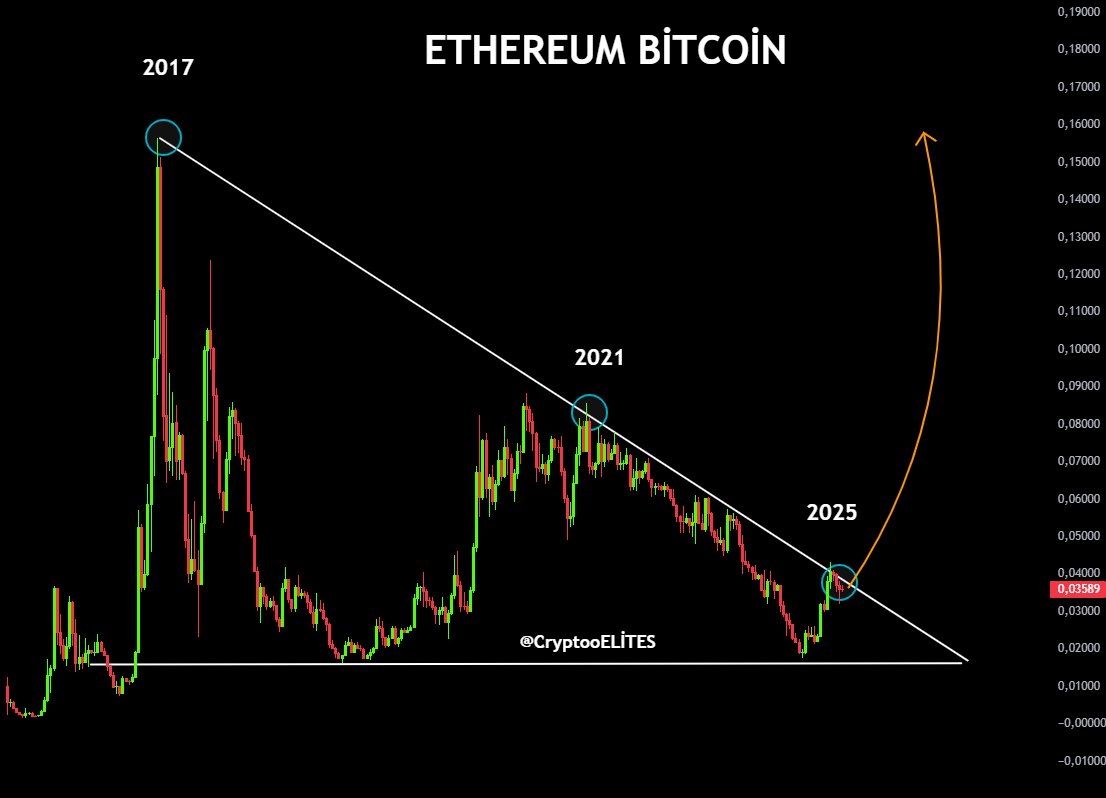

Market trends reflect this interplay. Ethereum’s price in December 2025 fluctuates around $3,000, with a market cap of approximately $360 billion. XRP, trading near $1.90, holds a $115 billion cap. Correlations show Ethereum’s ETF flows influencing prices with a 0.79 coefficient, per Medium analysis. Yet, XRP underperformed in 2025, down 13% year-to-date amid broader market corrections.

Fintech examples abound: Banks using Ethereum for tokenized assets now integrate XRP for settlements, blending ecosystems. As CoinDesk notes, Ethereum’s TVL rose despite price weakness, signaling ecosystem health.

To visualize trends, here’s an embedded chart from TradingView showing Ethereum’s performance against altcoins: <iframe src=”https://www.tradingview.com/chart/?symbol=ETHUSD” width=”100%” height=”400″ frameborder=”0″></iframe>

Ethereum vs Bitcoin: 2025 Could Mark a Historic Shift

Pros, Risks, and Common Misconceptions

The advantages of these upgrades are clear. Scalability boosts adoption; lower fees democratize access, much like how smartphones made computing portable. For altcoins, Ethereum’s improvements create spillover effects—enhanced liquidity and tools benefit projects like XRP by raising industry standards.

However, risks persist. Layer-2 centralization could introduce vulnerabilities, as seen in 2025’s Bybit hack, which exposed $1.5 billion in ETH due to custody issues. Upgrade delays, a historical pattern, might erode confidence. Volatility remains: Ethereum dipped 10% year-to-date by December 2025.

A common misconception is that upgrades will eliminate fees entirely. As DeFi researcher Vivek Raman explained, fees depend on demand; the Merge didn’t slash them, and neither will Fusaka alone. Another myth: Sharding means full fragmentation. In reality, danksharding supports rollups without splitting the core chain.

COINTURK NEWS – Bitcoin, Blockchain and Cryptocurrency News and …

Actionable Insights for Investors

For those navigating this space, monitor key indicators. Track Fusaka’s post-activation metrics, like blob usage and layer-2 TVL, via tools on ethereum.org. Diversify exposure: While Ethereum leads, altcoins like XRP offer complementary strengths in payments.

Consider staking: Pectra raised effective balances, easing entry for validators. Watch regulatory shifts—the U.S. GENIUS Act in 2025 clarified Ethereum’s status, boosting institutional inflows. Use analytics platforms to assess correlations; for example, XRP’s 5% gain in October 2025 mirrored Ethereum’s rally.

To deepen understanding, watch this explanatory video on Ethereum’s 2025 upgrades: video

Embracing a Long-Term Perspective

Ethereum’s upgrades underscore its commitment to resilience and innovation. By addressing scalability through danksharding and layer-2 optimizations, it not only strengthens its position but elevates the altcoin ecosystem. Impacts on tokens like XRP highlight a interconnected market where advancements in one chain spur evolution in others.

As 2025 closes, Ethereum’s trajectory points to a more efficient, inclusive blockchain world. Yet, challenges like volatility and competition remind us of the sector’s maturity phase.

What if Ethereum’s full scalability unlocks a new era of global finance—will altcoins adapt or be left behind?

Sources and References:

- Ethereum Roadmap: https://ethereum.org/en/roadmap/

- CoinGecko Ethereum Data: https://coingecko.com/en/coins/ethereum/historical_data

- CoinGecko XRP Data: https://coingecko.com/en/coins/ripple/historical_data

- CoinDesk State of the Blockchain 2025: https://www.coindesk.com/research/state-of-the-blockchain-2025

- Additional sources as cited inline.

(Note: This is not financial advice. Crypto is volatile; always DYOR and only invest what you can afford to lose.)