Ethereum faces scalability challenges. High fees and slow transactions limit its growth. Layer-2 solutions address these issues directly. They build on Ethereum’s base layer. This boosts efficiency without sacrificing security. As adoption rises in 2025, understanding layer-2 solutions matters for investors.

Imagine Ethereum as a busy highway. Congestion causes delays and high tolls. Layer-2 solutions act like express lanes. They handle traffic off the main road. Yet they connect back securely.

Why Layer-2 Solutions Matter in 2025

Crypto markets evolve fast. Ethereum remains dominant. But competition from faster chains grows. Layer-2 solutions keep it competitive. They reduce costs and speed up trades.

Recent data shows impact. Total value secured in Ethereum layer-2s hit $35.84 billion in December 2025. This marks a 20.6% rise over the year. Such growth signals broader adoption.

Fees have dropped too. Ethereum’s average fees fell to new lows in 2025. Layer-2s shift activity away from the main chain.

Understanding Layer-2 Solutions

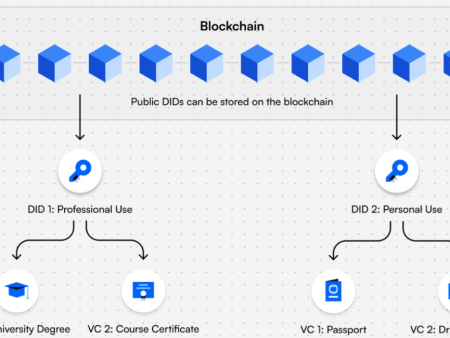

Layer-2 solutions process transactions off-chain. They bundle them for Ethereum to verify. This cuts congestion.

Two main types exist. Optimistic rollups assume validity first. Like Optimism. They challenge fraud later.

Zero-knowledge rollups prove batches upfront. Arbitrum uses a hybrid approach. Both reduce fees dramatically.

For example, a simple swap on Ethereum might cost $10. On Optimism, it’s pennies. Arbitrum offers similar savings.

Layer-2 solutions inherit Ethereum’s security. They post data back to layer-1. This ensures trustlessness.

Not all L2 technology are the same. You can break them all down …

How Layer-2 Solutions Reduce Fees

High gas fees deter users. Layer-2 solutions batch transactions. One bundle settles many actions.

This spreads costs. Users pay less per trade.

Data backs this. Ethereum fees hit 289 ETH lows in 2025. Yet TVL stays above $70 billion.

Layer-2s process 58.5% of ecosystem transactions now. This shift lowers mainnet pressure.

Arbitrum leads with over $12 billion TVL early in 2025. Optimism follows closely.

Ethereum Gas Fees Rising, But L2 Solutions Are Coming

Impact on Market Adoption

Lower fees draw more users. Beginners enter without high costs. This boosts DeFi and NFTs.

Layer-2 surge increased Ethereum activity by 20% in 2025. More dApps migrate.

Altcoins benefit too. Projects like Polygon integrate layer-2 tech. This scales beyond Ethereum.

Adoption spreads to enterprises. Faster, cheaper chains enable real-world use.

However, fragmentation poses challenges. Many layer-2s compete for liquidity.

Current Trends in Layer-2 Solutions

TVL grew 36.7% year-over-year to $43.3 billion. Arbitrum and Optimism dominate.

New upgrades like Dencun helped. They cut data costs further.

Trends point to consolidation. Dominant players will emerge by 2026.

Bitcoin explores layer-2s too. But Ethereum leads.

For visuals, check this TVL chart from L2Beat: Embed: https://l2beat.com/charts/tvl

Arbitrum vs Optimism: Which L2 Leads This Month? – InvestingHaven

Pros of Layer-2 Solutions

Speed stands out. Transactions confirm in seconds.

Fees drop significantly. This enables micro-transactions.

Security remains strong. Tied to Ethereum’s consensus.

Interoperability grows. Bridges connect chains easily.

Moreover, they support innovation. New protocols launch quickly.

Risks and Challenges

Centralization risks exist. Some layer-2s rely on sequencers.

Security breaches happen. Though rare, they impact trust.

Liquidity fragmentation occurs. Assets spread across networks.

Withdrawal delays apply. Optimistic rollups need challenge periods.

Finally, complexity confuses beginners. Learning curves steepen.

Common Misconceptions About Layer-2 Solutions

Many think layer-2s replace Ethereum. Not true. They enhance it.

Another myth: All layer-2s are identical. Types differ in tech.

Some believe fees stay low forever. Demand can push them up.

Also, security isn’t compromised. Data availability ensures it.

Clarifying these helps informed decisions.

Actionable Insights for Investors

Watch TVL growth. It signals health.

Consider tokens like OP and ARB. They govern networks.

Diversify across layer-2s. Reduce single-chain risk.

Monitor upgrades. Like Ethereum’s Prague update.

Track adoption metrics. User numbers matter.

Finally, test platforms yourself. Use small amounts first.

Long-Term Perspective on Layer-2 Solutions

Layer-2 solutions transform blockchain. They solve scalability effectively.

Ethereum’s ecosystem thrives. Adoption will accelerate.

Yet challenges remain. Innovation continues.

In summary, layer-2 solutions drive efficiency. They position crypto for mainstream use.

What if layer-2 solutions become the standard for all blockchains?

(Note: This is not financial advice. Crypto is volatile; always DYOR and only invest what you can afford to lose.)