Altcoins Stock Illustrations – 3,482 Altcoins Stock Illustrations …

The crypto market shifts fast. Emerging Altcoins to Watch are capturing attention amid this change. As Bitcoin dominates headlines, underdogs like Kaspa and Sui quietly build momentum. Why focus on them now? 2026 could bring breakouts driven by tech upgrades and adoption.

Institutions eye crypto more. Retail investors seek diversification. These altcoins offer fresh opportunities. Yet, volatility remains high. Smart choices matter.

Why Emerging Altcoins to Watch Matter Now

Crypto evolves beyond Bitcoin. Altcoins drive innovation. They solve real problems like speed and scalability.

2025 saw Bitcoin ETFs surge. Altcoins lagged but gained ground. Analysts predict altseason in 2026. Raoul Pal forecasts liquidity floods then.

Emerging ones stand out. They tackle blockchain limits. Think faster transactions or modular designs.

For investors, timing is key. Early entry yields gains. But research is essential.

Understanding Emerging Altcoins

Altcoins are cryptocurrencies besides Bitcoin. Emerging ones are lesser-known with growth potential.

Picture Bitcoin as the highway. Altcoins are side roads. Some are bumpy. Others lead to new destinations.

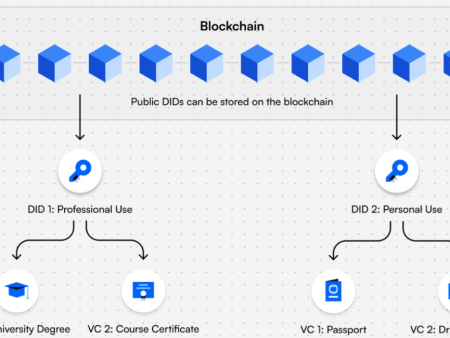

These underdogs use unique tech. Kaspa employs BlockDAG for speed. Sui leverages Move language for security.

They differ from established coins. Ethereum focuses on smart contracts. These aim for niche edges.

Analogy: Like startups versus giants. High risk, high reward.

Current Trends and Real-World Relevance

Altcoins integrate with fintech. DeFi grows. RWAs tokenize assets.

Sui powers gaming apps. Celestia aids data for rollups.

Adoption rises. Manta Pacific uses Celestia for fees.

Trends show modular chains leading. Celestia commands $1 billion in TVS.

Real-world use? Kaspa targets fast payments. Sui enables secure transfers.

2025 data: Crypto market cap hit trillions. Altcoins claim 40%.

Emerging Altcoins to Watch fit this shift. They enable oracles like Chainlink for data.

Chainlink’s oracles feed real-world info to contracts. This boosts altcoin utility.

For example, prices or weather data. It bridges crypto and reality.

Profiling Key Emerging Altcoins to Watch

Profile four underdogs. Each has strengths and risks.

Kaspa: Speed Demon

Kaspa Price Prediction 2025, 2026, 2030-2040: KAS Coin Price

Kaspa uses BlockDAG. Not traditional blockchain.

It processes over 3,000 TPS. That’s a data-backed insight.

Market cap: $1.26 billion. Price: $0.047. 24h change: +5.5%. ATH: $0.207.

Pros: High throughput. No pre-mine. Fair launch.

Risks: Competition from Solana. Volatility in PoW.

Misconception: It’s just another miner coin. Actually, it scales natively.

Community buzzes on X. Upgrades like 10 BPS planned.

View Kaspa’s chart on TradingView: https://tradingview.com/symbols/KASUSD/

Sui: Scalable Innovator

Sui Blockchain (Community Dataset) – Marketplace – Google Cloud …

Sui is Layer-1 for assets. Uses object-centric model.

Performance: 125,000 TPS.

Market cap: $5.4 billion. Price: $1.44. 24h change: +0.8%. ATH: $5.35.

Pros: Fast finality. Move language prevents bugs.

Risks: Centralization concerns. Token unlocks.

Misconception: It’s like Solana. But focuses on privacy.

Trends: Outperformed Bitcoin in 2025.

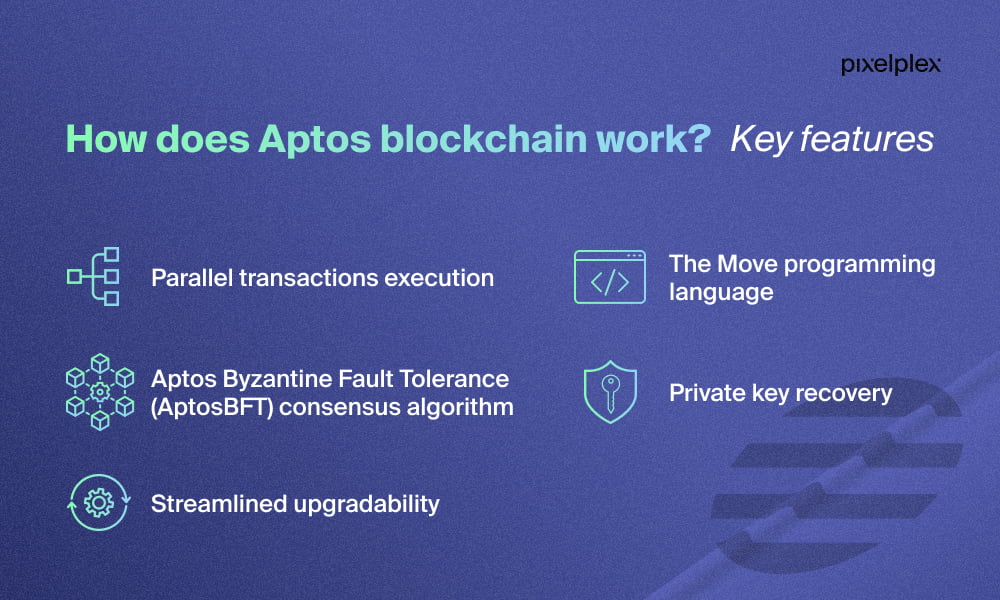

Aptos: Secure Layer-1

Aptos Blockchain: The Future of Secure and Transparent Transactions

Aptos stems from Diem. Emphasizes safety.

Metrics: High staking rate at 73%.

Market cap: $1.17 billion. Price: $1.56. 24h change: +2.0%. ATH: $19.92.

Pros: Move VM for devs. Quantum-resistant plans.

Risks: Price downside. Unlocks in 2025.

Misconception: It’s failed Meta project. Now independent.

Prospects: Could hit $6 in 2025.

Celestia: Data Specialist

What is Celestia? A Comprehensive Overview of the First Modular …

Celestia provides data availability. Modular focus.

Adoption: Powers multiple L2s.

Market cap: $390 million. Price: $0.457. 24h change: +3.3%. ATH: $20.85.

Pros: Lowers costs 95%. Enables onchain apps.

Risks: Fragmentation. Low fees now.

Misconception: Just another L1. It’s specialized DA.

2025 saw rollup growth. Celestia leads.

Pros, Risks, and Common Misconceptions

Overall pros: Innovation drives value. Speed and modularity attract devs.

However, risks abound. Market dumps possible. Tech failures rare but real.

Misconception: All altcoins are scams. Many solve issues.

Another: Hype equals success. Fundamentals matter more.

Chainlink aids these. Oracles enable data for contracts. Boosts relevance.

For instance, price feeds for DeFi.

Actionable Insights

Monitor upgrades. Kaspa’s Rust in Q2.

Watch listings. Binance for Kaspa?

Diversify small. Track metrics on CoinGecko.

Read whitepapers. Join communities.

Consider Chainlink integration. It enhances utility.

Stay informed via X. Follow trends.

What to do? Research deeply. Set alerts.

Conclusion: A Long-Term View

Emerging Altcoins to Watch hold promise for 2026. Tech advances could spark breakouts.

Patience pays. Focus on utility.

Yet, markets fluctuate. Underdogs may rise.

Will these altcoins redefine crypto by 2027?

Note: This is not financial advice. Crypto is volatile; always DYOR and only invest what you can afford to lose.