Selig Takes Over CFTC: Why XRP Holders Should Be Optimistic About 2026 Catalysts

Selig Takes Over CFTC: Why XRP Holders Should Be Optimistic About 2026 Catalysts

As 2025 draws to a close, the cryptocurrency landscape is shifting under new regulatory leadership. Michael Selig’s recent swearing-in as the 16th Chairman of the Commodity Futures Trading Commission (CFTC) marks a pivotal moment. For XRP holders, this development signals potential optimism. Selig’s pro-innovation stance, combined with expanding Ripple initiatives like RLUSD and On-Demand Liquidity (ODL), could unlock significant 2026 catalysts. However, these changes come amid broader market dynamics worth examining closely.

GSA to relocate CFTC headquarters to D.C.’s Patriots Plaza …

Understanding the Core Elements

The CFTC oversees futures and derivatives markets, including those involving digital assets classified as commodities. XRP, the native token of the XRP Ledger (XRPL), has long navigated regulatory gray areas. Unlike Bitcdefioin or Ethereum, XRP focuses on facilitating cross-border payments through Ripple’s network.

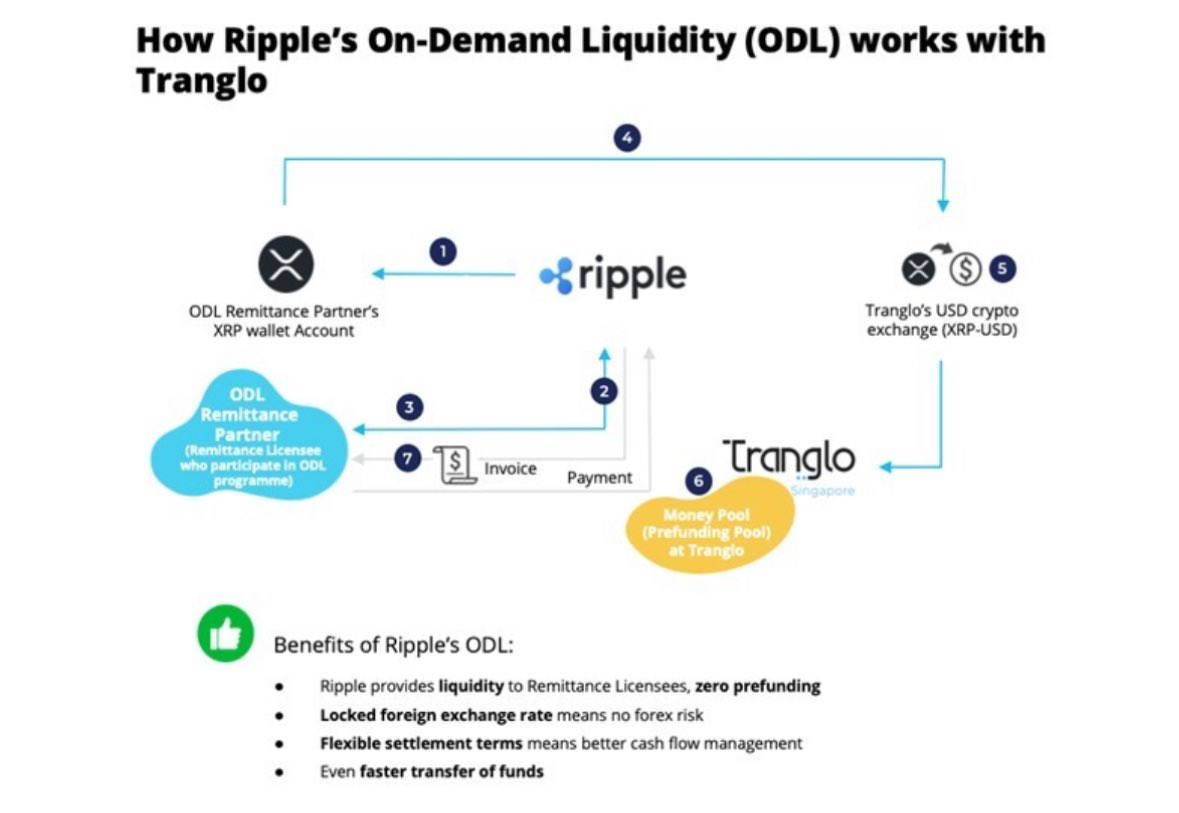

RLUSD is Ripple’s dollar-pegged stablecoin, designed for stability and compliance. It aims to integrate seamlessly with traditional finance. Meanwhile, ODL uses XRP as a bridge currency for instant settlements, reducing the need for pre-funded accounts in international transfers.

Chainlink’s oracles add another layer. These are decentralized networks that feed real-world data into blockchain smart contracts. Imagine a smart contract as a self-executing vending machine—it needs external inputs like stock prices or weather data to function. Without oracles, blockchains remain isolated from off-chain information.

For altcoins like XRP, oracles enable advanced applications. They bridge the “oracle problem,” where smart contracts can’t natively access external data without risking centralization or manipulation.

Regulatory Tailwinds and Current Trends

Selig’s appointment aligns with President Trump’s push for digital assets. Nominated in October 2025 and confirmed by the Senate in December, Selig brings a crypto-friendly perspective from his background in the industry. He has emphasized clarity in market structure legislation, potentially heading to Trump’s desk soon.

Trump’s administration has issued executive orders to bolster U.S. leadership in blockchain technology. A January 2025 order promotes responsible growth of digital assets, encouraging innovation while addressing risks. This policy framework could classify more altcoins under CFTC oversight, reducing SEC-related uncertainties that have plagued XRP.

Meanwhile, RLUSD has seen rapid adoption. By November 2025, it surpassed a $1 billion market cap—one of the fastest climbs for a regulated stablecoin. Expansions into markets like Japan highlight its potential to integrate with global finance.

ODL volumes are also climbing. In Q2 2025, Ripple reported $1.3 billion in ODL transactions, a 41% year-over-year increase. This growth positions XRP to capture a slice of the $150 trillion annual cross-border payments market, currently dominated by systems like SWIFT.

How US Bank Failures Disrupted XRP and Ripple’s ODL System

Beyond payments, Chainlink’s oracles are gaining traction. As of October 2025, Chainlink secures over $100 billion in value across more than 2,400 integrations, holding about 70% of the oracle market share. This dominance underscores their role in enabling real-world data for altcoin ecosystems.

The Role of Oracles in Altcoin Evolution

Chainlink’s oracles solve a fundamental blockchain limitation. Smart contracts on networks like Ethereum or emerging XRPL sidechains need reliable off-chain data to execute complex logic. For instance, a decentralized insurance contract might require weather reports to trigger payouts.

In the altcoin space, this is transformative. Altcoins often specialize in niches like payments (XRP) or decentralized finance (DeFi). Oracles allow these to interact with real-world events, such as asset prices or supply chain updates.

Consider XRP’s potential. With XRPL’s planned EVM-compatible sidechain, smart contracts could leverage Chainlink oracles for tokenizing real estate or commodities. This integration could amplify 2026 catalysts by expanding XRP’s utility beyond remittances.

Yet, Chainlink isn’t without competition. Other oracles exist, but its decentralized model—where node operators stake tokens for accuracy—sets a standard. As adoption grows, expect more altcoins to rely on such infrastructure for scalability.

How Chainlink Supports Any Off-Chain Data Resource and Computation

Pros, Risks, and Common Misconceptions

On the positive side, Selig’s leadership could accelerate regulatory clarity, fostering institutional inflows. Trump’s digital asset policies emphasize U.S. competitiveness, potentially easing barriers for innovations like RLUSD expansions.

ODL’s efficiency is another strength. By using XRP for liquidity, it cuts costs and speeds up transfers—ideal in a world of rising remittance flows, estimated at $690 billion in 2025. Chainlink’s oracles further enhance this by enabling data-driven smart contracts, opening doors to DeFi and real-world asset tokenization.

However, risks persist. Crypto markets remain volatile, influenced by macroeconomic factors like Federal Reserve interest rates. A reversal in rate cuts could dampen enthusiasm.

Regulatory shifts carry uncertainty too. While Selig is pro-innovation, enforcement actions or delays in legislation could stall progress. Competition from other stablecoins or payment networks adds pressure.

A common misconception is that XRP is solely controlled by Ripple. In reality, the XRPL is decentralized, with validators worldwide. Another myth: Oracles like Chainlink eliminate all risks—they mitigate but don’t erase data manipulation possibilities if networks are compromised.

Actionable Insights for Investors

First, monitor legislative developments. Watch for the crypto market structure bill potentially reaching Trump’s desk, as Selig has indicated. This could define clearer boundaries between SEC and CFTC oversight.

Track RLUSD and ODL metrics. Ripple’s partnerships, especially in Asia, signal growth. If ODL volumes continue their upward trajectory, it could boost XRP demand.

Consider oracle integrations. As Chainlink expands into capital markets—projected to accelerate in 2026—look for collaborations with altcoin projects like XRP. This might enable new use cases, such as tokenized assets on XRPL.

Evaluate broader trends. Federal Reserve policies on interest rates will influence liquidity. Positive catalysts like XRP ETFs could drive inflows, potentially pushing prices toward $5 by 2026.

Finally, diversify thoughtfully. While optimistic about 2026 catalysts, balance exposure with market volatility in mind.

XRP Price Prediction for December 2025 – What Could $XRP Be Worth …

Embracing a Long-Term Perspective

Looking ahead, Selig’s CFTC tenure, paired with Trump’s digital asset initiatives, sets a foundation for growth. RLUSD expansions and ODL advancements position XRP for real-world utility. Meanwhile, Chainlink’s oracles could supercharge altcoin smart contracts, creating synergies in DeFi and beyond.

Yet, success hinges on execution. Regulatory tailwinds must translate into actionable frameworks. For XRP holders, these 2026 catalysts represent opportunity amid evolution.

As the crypto ecosystem matures, will these 2026 catalysts finally bridge traditional finance and digital assets, or will unforeseen challenges alter the trajectory?

References

- Michael Selig Sworn In as 16th CFTC Chairman – https://www.cftc.gov/PressRoom/PressReleases/9164-25

- Michael Selig Confirmed as CFTC Chairman: Six Issues to Watch in 2026 – https://www.wilmerhale.com/en/insights/client-alerts/20251218-michael-selig-confirmed-as-cftc-chairman—six-issues-to-watch-in-2026

- Trump taps crypto regulator Mike Selig as new CFTC chair nominee – https://subscriber.politicopro.com/article/2025/10/trump-mike-selig-cftc-00621525

- Senate confirms Trump crypto-friendly nominees to take over CFTC – https://www.coindesk.com/policy/2025/12/11/senate-confirms-trump-crypto-friendly-nominees-to-take-over-cftc-fdic

- Strengthening American Leadership in Digital Financial Technology – https://www.whitehouse.gov/presidential-actions/2025/01/strengthening-american-leadership-in-digital-financial-technology

- Ripple (@Ripple) / Posts / X – Twitter – https://x.com/Ripple

- Is XRP the Most Undervalued Crypto in 2026? The Case for $5 and Against It – https://247wallst.com/investing/2025/12/23/is-xrp-the-most-undervalued-crypto-in-2026-the-case-for-5-and-against-it/

- XRP Could Capture 14% of SWIFT’s $150 Trillion by 2030 – https://finance.yahoo.com/news/ripple-bold-claim-xrp-could-144043007.html

- Chainlink: A Full-Stack Institutional Platform – https://messari.io/report/chainlink-a-full-stack-institutional-platform

- Chainlink in 2025: The Final Stage of Blockchain Adoption Is Coming – https://blog.chain.link/chainlink-2025/

(Note: This is not financial advice. Crypto is volatile; always DYOR and only invest what you can afford to lose.)

[…] a mixed bag: peaks at $3.65 in July gave way to consolidation, ending with that 11% slump. Now, for 2026, the narrative flips. If ETF inflows reach $10 billion—a plausible scenario given current $1.25 […]