As we step into 2026, financial resolutions 2026 are top of mind for many investors navigating a shifting economic landscape.

Financial Resolutions for 2026: Smart Money Moves in a Moderating Market

As we step into 2026, financial resolutions 2026 are top of mind for many investors navigating a shifting economic landscape. The new year brings fresh opportunities to reassess and strengthen your financial footing, especially with market forecasts pointing to moderated growth. Whether you’re a fund manager overseeing portfolios or a retail investor building wealth, setting realistic goals now can pave the way for stability amid uncertainty. This article explores smart strategies like bolstering emergency funds, maximizing retirement contributions, and tweaking investment portfolios in response to expected S&P 500 returns of around 10-15%—a slowdown from recent highs but still positive territory.

Think of your finances as a well-tuned engine. In a moderating market, you don’t rev it to the redline; instead, you focus on efficiency and maintenance to ensure it runs smoothly over the long haul.

S&P 500 Forecast 2026: Can the Index Reach 8,000–8,100? | EBC …

Alt: S&P 500 forecast chart for financial resolutions 2026

Why Financial Resolutions 2026 Are Crucial Now

The start of a new year often sparks a surge in goal-setting, and with good reason. January sees high search volumes for terms like “financial resolutions 2026,” as people reflect on past performance and plan ahead. But why does this matter in 2026 specifically? The global economy is expected to grow at a sturdy but moderated pace of about 2.8%, with developed markets seeing easing inflation and declining policy rates. This environment, while resilient, demands caution—AI-driven spending and consumer strength will support growth, but risks like sticky inflation or recession (with a 35% probability) loom.

In this context, financial resolutions 2026 aren’t just about wishful thinking. They’re about adapting to a market where S&P 500 earnings growth is projected at 15%, up from 12% in 2025, yet facing headwinds from high valuations and potential volatility. For instance, Goldman Sachs predicts the index hitting 7,600 by year-end, implying roughly 10% gains from current levels. Meanwhile, crypto markets are poised for transformation, with institutional adoption driving valuations higher across sectors like Bitcoin and altcoins.

Without deliberate steps, it’s easy to drift. However, by focusing on foundational moves, you can build resilience. Let’s break down the key concepts.

Explaining Core Financial Resolutions 2026 in Plain English

At their heart, financial resolutions 2026 revolve around three pillars: protection, growth, and adaptation. First, building an emergency fund acts as your financial safety net. Experts recommend saving three to six months of living expenses in a liquid, low-risk account—like a high-yield savings option yielding around 4-5% in today’s rates. This isn’t fancy; it’s essential. Imagine your car breaking down or a sudden job loss—without this buffer, you might dip into investments at a loss.

Next, maxing out retirement contributions. For 2026, the 401(k) limit rises to $24,500 for employee deferrals, with a total combined limit of $72,000 including employer matches. If you’re 50 or older, add a $8,000 catch-up; for ages 60-63, it’s up to $11,250. This is like planting seeds in fertile soil—tax advantages compound over time, turning modest inputs into substantial nests.

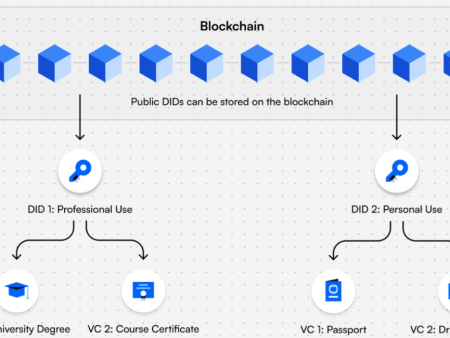

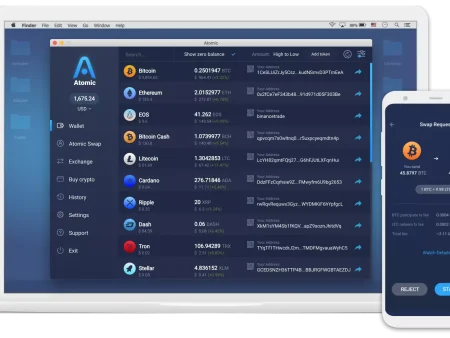

Finally, adjusting portfolios in a moderating market. With S&P 500 forecasts ranging from 7,600 (Goldman) to 8,300 (Seeking Alpha), expect single to low-double-digit gains. This means shifting from aggressive growth stocks to a balanced mix, perhaps incorporating bonds or dividend payers for stability. In crypto, it’s similar: diversify beyond Bitcoin into tokenized assets or DeFi protocols enabled by oracles like Chainlink, which bring real-world data into smart contracts for more reliable applications.

These aren’t complex ideas. They’re straightforward adjustments, much like recalibrating a GPS when traffic slows.

2026 401(k) and IRA Contribution Limits – Modern Wealth Management

Alt: Retirement savings graph 401k contributions for financial resolutions 2026

Current Trends and Real-World Relevance in 2026

The moderating market of 2026 isn’t a downturn—it’s a normalization. Global growth is forecasted at 3.2%, supported by resilient U.S. consumer spending and AI investments. Yet, exports and property markets in regions like China may drag, leading to moderate U.S. GDP expansion. Wall Street consensus sees the S&P 500 climbing 13-15%, driven by tech giants contributing 46% of earnings growth.

In the real world, this translates to opportunities in fintech and digital assets. Crypto’s outlook is bullish, with tokenization expanding into private markets and consumer apps. For example, Chainlink’s oracles are enabling altcoin smart contracts to access off-chain data, like stock prices or weather events, making DeFi more practical for everyday finance. Institutional inflows via ETFs could push Bitcoin past previous highs early in the year.

Data backs this shift: A recent Grayscale report predicts the “dawn of the institutional era” for crypto, with valuations rising across all sectors. Meanwhile, emergency funds are more relevant than ever, with experts urging $1,000 starters before scaling to six months’ expenses amid potential job market volatility.

These trends underscore why financial resolutions 2026 must align with broader economic realities, blending traditional and innovative assets.

Risk-On Reloaded: Monetary Easing, Catch-up Trades, and the …

Alt: Crypto portfolio adjustment in moderating market for financial resolutions 2026

Pros, Risks, and Common Misconceptions

Embracing these resolutions offers clear pros. Building an emergency fund provides peace of mind and prevents forced selling in down markets. Maxing 401(k)s leverages tax deferrals, potentially growing $24,500 contributions into hundreds of thousands over decades via compounding. Portfolio adjustments can mitigate losses; for instance, diversifying into crypto via regulated ETFs reduces reliance on volatile stocks.

However, risks exist. Emergency funds in low-yield accounts erode to inflation if not optimized. Over-contributing to retirement without liquidity can strain cash flow. In a moderating market, misjudging trends—like over-allocating to tech amid high valuations—could lead to underperformance. Crypto adds volatility; while oracles like Chainlink enhance reliability, smart contract hacks remain a threat.

Common misconceptions? One is that emergency funds are only for the unemployed—actually, they’re for any unexpected hit. Another: Retirement maxing is just for the wealthy; even partial contributions compound powerfully. In crypto, hype overshadows reality—it’s not a get-rich-quick scheme but a tool for diversification, as seen in institutional adoption.

Addressing these head-on ensures your financial resolutions 2026 are grounded.

6 Money Resolutions for a Stronger Financial Future in 2026 …

Alt: Emergency fund building infographic for financial resolutions 2026

Actionable Insights for Implementing Financial Resolutions 2026

Ready to act? Start by assessing your current position. Calculate three months’ expenses and automate transfers to a high-yield account until you hit that mark. For retirement, review your 401(k) elections—increase to the $24,500 limit if feasible, or at least meet employer matches for “free money.”

On portfolios, watch key indicators: If S&P valuations climb further, trim growth stocks and add bonds. In crypto, consider allocating 5-10% to diversified holdings, using platforms with Chainlink integrations for data accuracy. Track progress quarterly—use apps for budgeting and rebalancing.

Think long-term: What economic shifts, like AI or tokenization, should you monitor? Adjust as needed, but avoid reactive changes.

Wrapping Up: A Long-Term View on Financial Resolutions 2026

In summary, financial resolutions 2026 are about steady progress in a moderating market—protecting what you have, growing wisely, and adapting smartly. By focusing on emergency funds, retirement maxes, and balanced portfolios, you position yourself for sustained success, even as growth tempers.

What if the key to financial freedom isn’t chasing highs, but mastering the moderates? How will you adapt your strategy in 2026?

References Used for This Article

- IRS. “401(k) limit increases to $24,500 for 2026, IRA limit increases to $7,500.” https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500

- Fidelity Investments. “401(k) contribution limits 2025 and 2026.” https://www.fidelity.com/learning-center/smart-money/401k-contribution-limits

- Seeking Alpha. “2026 S&P 500 Outlook: Why The Index Will Hit 8,300.” https://seekingalpha.com/article/4856393-2026-s-and-p-500-outlook-why-the-index-will-hit-8300

- Goldman Sachs. “The Global Economy Is Forecast to Post ‘Sturdy’ Growth of 2.8% in 2026.” https://www.goldmansachs.com/insights/articles/the-global-economy-forecast-to-post-sturdy-growth-in-2026

- Morgan Stanley. “2026 Economic Outlook: Moderate Growth.” https://www.morganstanley.com/insights/articles/global-economic-outlook-2026

- Coinbase. “2026 Crypto Market Outlook.” https://www.coinbase.com/institutional/research-insights/research/market-intelligence/2026-crypto-market-outlook

- Grayscale. “2026 Digital Asset Outlook: Dawn of the Institutional Era.” https://research.grayscale.com/reports/2026-digital-asset-outlook-dawn-of-the-institutional-era

- Empower. “Ten financial resolutions for 2026.” https://www.empower.com/the-currency/life/ten-financial-resolutions-for-new-year

- Thrivent. “Best Places to Keep Your Emergency Fund in 2026.” https://www.thrivent.com/insights/budgeting-saving/best-places-to-keep-your-emergency-fund-in-2025

- AP News. “Building an emergency fund can feel daunting, but these tips can help.” https://apnews.com/article/emergency-fund-budgeting-finances-your-money-f81e62eaeacdbade93bd91fe77383e75

(Note: This is not financial advice. Crypto is volatile; always DYOR and only invest what you can afford to lose.)