In the dynamic world of digital finance, cryptocurrency whitepapers stand as essential blueprints for innovative projects.

How to Read and Understand Cryptocurrency Whitepapers

In the dynamic world of digital finance, cryptocurrency whitepapers stand as essential blueprints for innovative projects. With over 560 million global cryptocurrency users as of 2024 and the market showing sideways action amid volatility in late 2025, mastering how to read and understand cryptocurrency whitepapers empowers investors to separate genuine opportunities from fleeting hype. This guide walks you through the process, using real-world examples like Bitcoin, Ethereum, and Chainlink to illustrate key points.

What Are Cryptocurrency Whitepapers?

Cryptocurrency whitepapers are technical documents that detail a project’s purpose, mechanics, and roadmap. Think of them as a business plan combined with an engineering schematic. They originated from Bitcoin’s 2008 paper by Satoshi Nakamoto, which introduced a peer-to-peer electronic cash system without intermediaries.

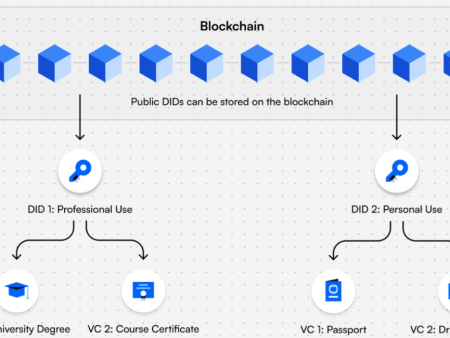

These papers explain the problem a project solves, its proposed solution, and how it integrates with blockchain technology. For instance, they might outline how a token functions within an ecosystem or how smart contracts interact with real-world data. However, not all whitepapers are created equal. Some are dense with jargon, while others prioritize clarity.

Why bother reading them? In a market with over 17,000 cryptocurrencies, whitepapers provide the raw insights needed to evaluate viability. They reveal whether a project has substance or is just vaporware.

Key Sections to Focus On in Cryptocurrency Whitepapers

Most cryptocurrency whitepapers follow a logical structure. Breaking them down section by section makes analysis manageable.

Abstract and Introduction

Start here for the big picture. The abstract summarizes the project’s goals, while the introduction hooks you with the problem statement. Look for clear explanations of why the project exists. For example, Bitcoin’s introduction highlights the flaws in trusted third-party payments, proposing a trustless alternative.

Problem and Solution

This core duo defines the project’s value. The problem section identifies market gaps, like Bitcoin addressing double-spending without banks. The solution details how the technology fixes it—often with analogies, such as comparing blockchain to an unbreakable ledger.

Technical Architecture

Dive into the nuts and bolts: consensus mechanisms, scalability solutions, and security features. Ethereum’s whitepaper, for instance, explains its Turing-complete virtual machine, enabling smart contracts beyond simple transactions.

Tokenomics and Economics

Understand the token’s role. Sections on supply, distribution, and incentives reveal sustainability. Chainlink’s whitepaper discusses its LINK token for oracle payments, ensuring network security through staking.

Team, Roadmap, and Governance

Credible teams list verifiable credentials. Roadmaps outline milestones with timelines. Governance explains decision-making, like DAOs in Ethereum-based projects.

Risks and Legal Considerations

Honest whitepapers acknowledge challenges, such as regulatory hurdles or technical risks.

How a Bitcoin transaction works (a good infographic for explaining …

Analyzing Examples of Cryptocurrency Whitepapers

To apply these concepts, let’s examine three landmark whitepapers.

Bitcoin Whitepaper: The Pioneer

Published in 2008, Bitcoin’s nine-page document is concise yet revolutionary. Its abstract proposes peer-to-peer cash to avoid financial institutions. Key sections include proof-of-work for consensus and incentives via mining rewards. The paper uses simple math to calculate attack probabilities, showing security through CPU power.

Red flag avoidance: It’s grounded in real problems like reversibility in online payments. Analogy: Proof-of-work is like solving a puzzle to seal a letter, preventing tampering.

Ethereum Whitepaper: Building a Programmable Blockchain

Vitalik Buterin’s 2014 paper expands Bitcoin’s model. The introduction critiques Bitcoin’s limited scripting, proposing a Turing-complete platform for decentralized apps. Sections on state transitions and gas fees explain execution limits to prevent abuse.

Real-world relevance: It enables derivatives, identity systems, and DAOs. Data-backed insight: Projects with well-defined timelines, like Ethereum’s roadmap, have a 45% higher success rate in meeting objectives, per research on DeFi initiatives.

Cracking the Ethereum White Paper | by Bo | Medium

Chainlink Whitepaper: Oracles for Real-World Data

Chainlink’s v1 (2017) and v2 (2021) whitepapers focus on decentralized oracles, enabling smart contracts to access off-chain data securely. The introduction addresses blockchain isolation, proposing networks of nodes for tamper-proof feeds.

Key sections: Architectural overview details on-chain (reputation, aggregation) and off-chain components (adapters). Security emphasizes decentralization to mitigate faults. Tokenomics highlight LINK for payments and staking, with super-linear incentives against bribery.

Example: In altcoin smart contracts, Chainlink oracles fetch prices for DeFi lending, preventing manipulation. This bridges crypto with fintech, like insurance using IoT data.

Chainlink 2.0 Lays Foundation for Adoption of Hybrid Smart Contracts

Current Trends and Real-World Relevance of Cryptocurrency Whitepapers

As crypto matures, whitepapers evolve. In 2026, trends include emphasis on hybrid smart contracts, as in Chainlink 2.0, integrating off-chain computation for efficiency. With regulatory progress like the GENIUS Act boosting stablecoins to $300 billion in 2025, whitepapers now detail compliance and cross-chain interoperability.

Real-world impact: Whitepapers guide investments in sectors like DeFi and NFTs. For context, the number of cryptocurrencies has exploded historically.

(Chart: Historical growth in the number of cryptocurrencies, sourced from CoinMarketCap and Statista data approximations up to 2025.)

This growth underscores why understanding cryptocurrency whitepapers is vital—more projects mean more noise.

For engagement, watch this tutorial video on reading whitepapers: Crypto Whitepapers Explained.

Top 10 Crypto/Blockchain Infographics You Must Know

Pros, Risks, and Common Misconceptions in Cryptocurrency Whitepapers

Pros: They foster informed decisions, revealing innovative tech like Chainlink’s oracles for altcoin contracts. Risks include plagiarism or vagueness, leading to rug pulls.

Common misconceptions: A whitepaper guarantees success—many failed ICOs had polished ones. Another: Technical depth equals quality; overhyped language often masks flaws.

Red flags: Anonymous teams, unrealistic promises, or lack of verifiable claims. Overly salesy tone signals hype over substance.

Crypto Rug Pulls: Complete Guide | Koinly

Actionable Insights: Tips for Beginners on Reading Cryptocurrency Whitepapers

Start small: Read Bitcoin’s first for practice. Use tools like glossaries for jargon. Cross-reference claims with audits or community forums.

Watch for: Realistic roadmaps, strong tokenomics, and transparent teams. Do: Verify sources, check GitHub activity, and assess market fit.

Think long-term: Focus on utility, not short-term gains. For Chainlink-like projects, evaluate oracle integration for real-world applicability.

Conclusion: Embracing a Long-Term Perspective

Mastering cryptocurrency whitepapers equips you to navigate crypto’s complexities with confidence. By focusing on structure, examples, and red flags, you’ll make sharper decisions in this volatile space. Remember, true value lies in sustainable innovation, not hype.

What cryptocurrency whitepaper will you dissect next to uncover potential gems in the market?

Top Ten References Used for This Article

- Bitcoin Whitepaper – https://bitcoin.org/bitcoin.pdf

- Ethereum Whitepaper – https://ethereum.org/en/whitepaper/

- Chainlink Whitepaper v1 – https://research.chain.link/whitepaper-v1.pdf

- Chainlink Whitepaper v2 – https://research.chain.link/whitepaper-v2.pdf

- How to Read and Analyze a White Paper – https://coinmarketcap.com/academy/article/how-to-read-and-analyze-a-white-paper

- Red Flags in Cryptocurrency Whitepapers – https://essentialdata.com/red-flags-of-a-cryptocurrency-white-paper/

- Cryptocurrency Market Statistics – https://www.statista.com/statistics/863917/number-crypto-coins-tokens/

- Success Rate of Crypto Projects – https://mas-digital.io/decoding-crypto-whitepapers-a-guide-to-evaluating-projects/

- 2026 Crypto Market Outlook – https://www.coinbase.com/institutional/research-insights/research/market-intelligence/2026-crypto-market-outlook

- Global Cryptocurrency Ownership Data – https://www.triple-a.io/cryptocurrency-ownership-data

(Note: This is not financial advice. Crypto is volatile; always DYOR and only invest what you can afford to lose.)