What Is Chainlink? A Beginner’s Guide

Introduction: The Bridge Between Blockchains and Reality

Imagine a smart contract as a self-executing vending machine. It dispenses outcomes based on predefined rules, but it can’t reach out to check the weather or stock prices on its own. This isolation is the “oracle problem,” a core limitation of blockchain technology that Chainlink addresses head-on. In an era where decentralized finance (DeFi) protocols manage billions in assets. Reliable access to real-world data is no longer optional—it’s essential for scaling altcoin ecosystems beyond Ethereum.

As altcoins like Polygon, Avalanche, and BNB Chain gain traction, Chainlink’s oracles provide the infrastructure to integrate external data securely. This matters now because DeFi’s total value locked (TVL) has surged, demanding tamper-proof feeds for everything from lending rates to insurance payouts. Without oracles, smart contracts remain blind to the outside world, stifling innovation in tokenized assets and cross-chain applications.

Understanding Chainlink Oracles in Plain English

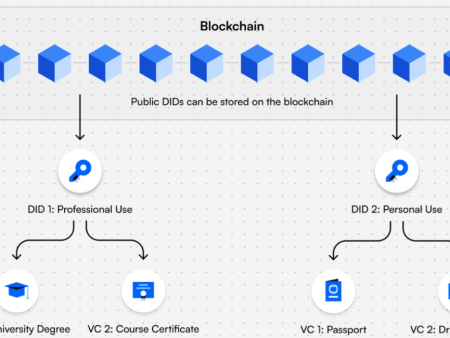

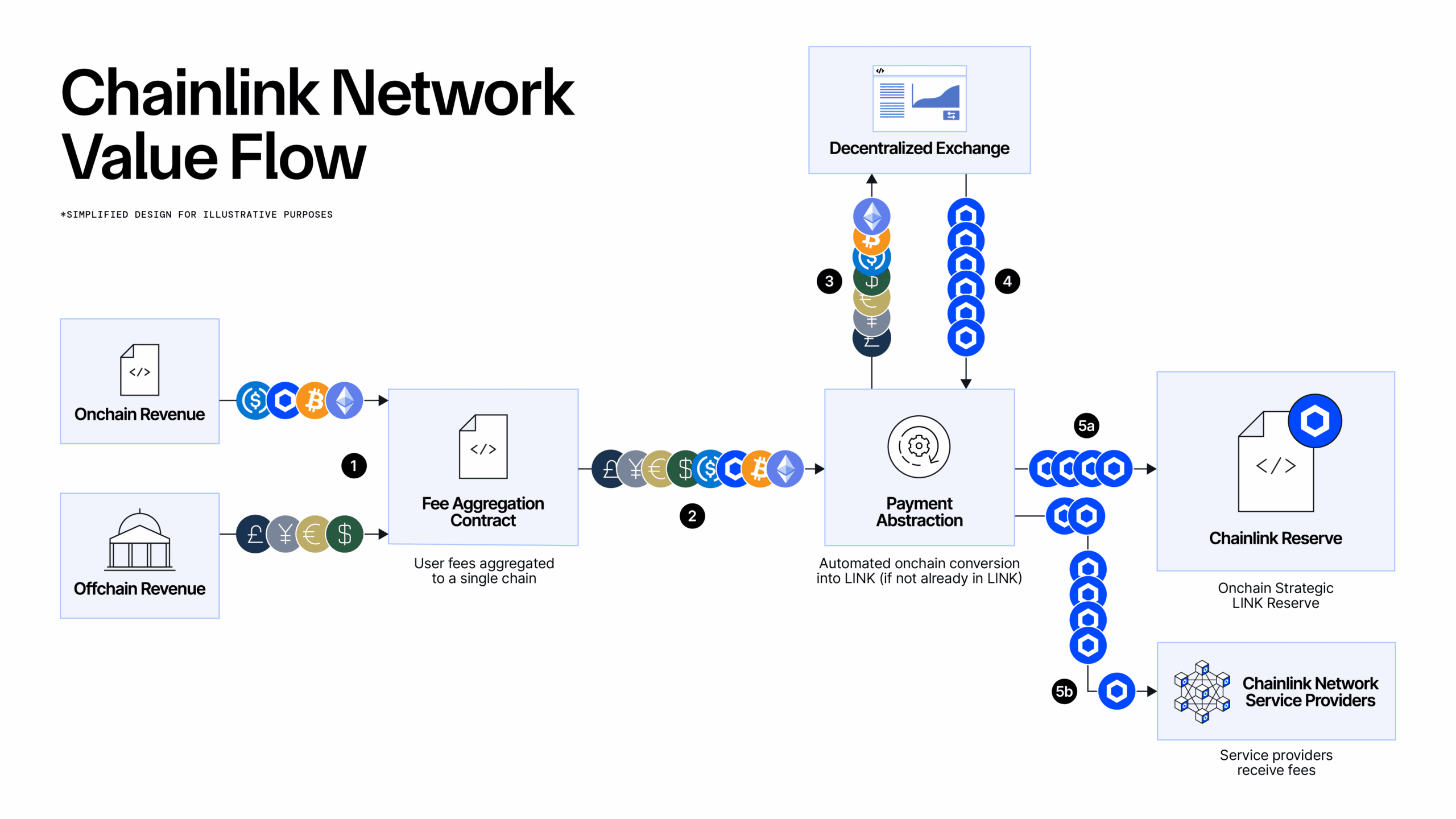

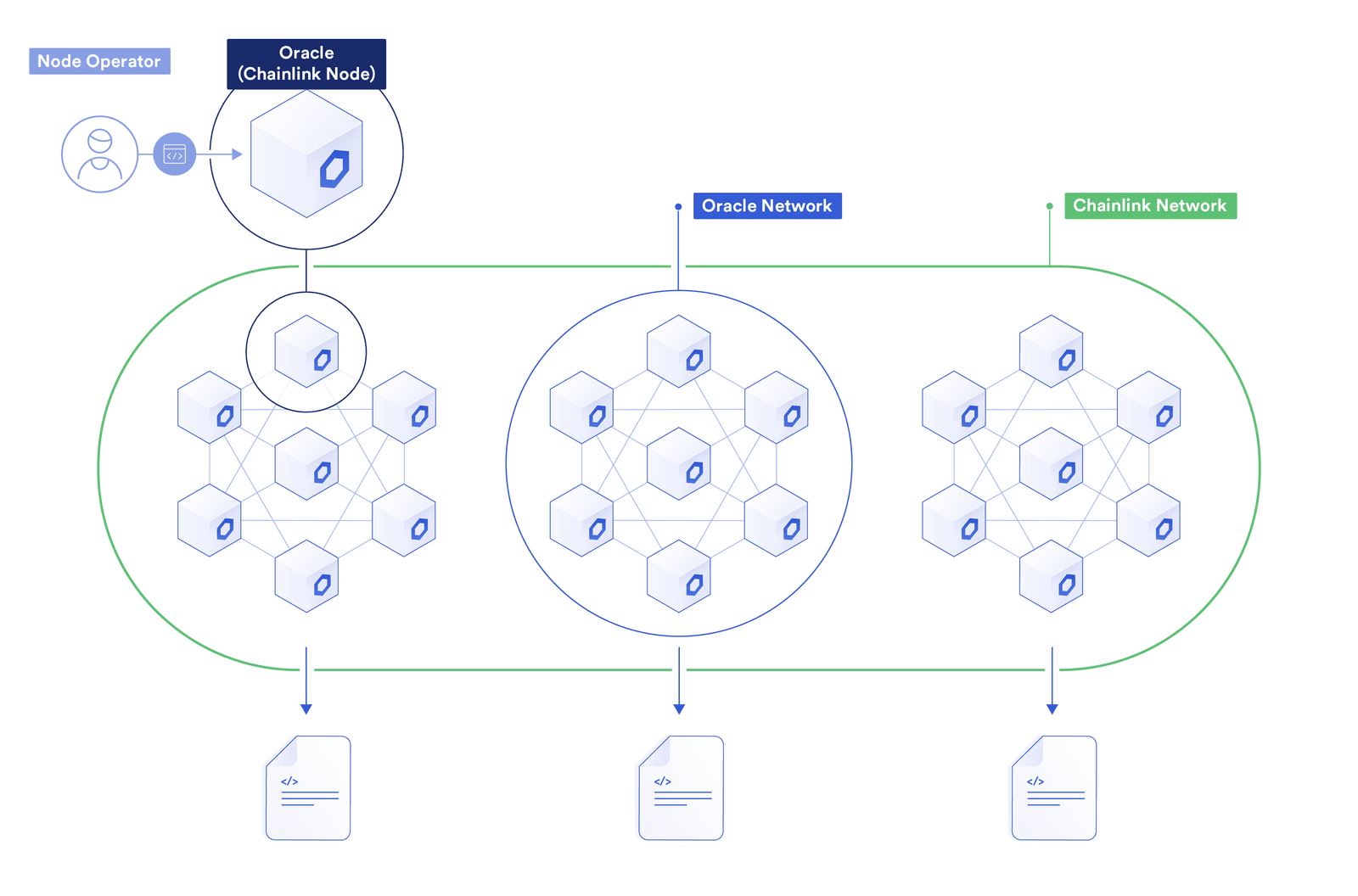

At its core, an oracle is a data bridge. Blockchains are deterministic systems—they produce the same output for the same input every time—but they can’t natively access off-chain information like API data or real-time events. Chainlink solves this by operating a decentralized oracle network (DON), where multiple independent node operators fetch, verify, and deliver data to smart contracts.

Think of it like a jury system: instead of trusting one witness (a centralized oracle, prone to manipulation), Chainlink aggregates inputs from dozens of sources. Node operators stake LINK tokens as collateral, incentivizing accuracy; faulty data leads to slashing penalties. This setup ensures reliability across blockchains, enabling altcoin smart contracts to interact with real-world inputs without compromising decentralization.

For example, in DeFi, Chainlink’s price feeds supply accurate asset valuations to protocols on Solana or Cardano, preventing exploits from outdated data. Unlike single-point oracles, Chainlink’s model uses off-chain reporting to consensus-build before on-chain submission, reducing gas costs and enhancing security.

What Is a Chainlink Node Operator?

Current Trends and Real-World Relevance in DeFi

Chainlink’s influence in DeFi is profound, powering over 2,400 integrations across more than 14 blockchain ecosystems as of 2025. It secures upwards of $100 billion in DeFi value, holding approximately 69.9% of the oracle market share. This dominance stems from its ability to deliver not just price data but also cross-chain messaging via the Cross-Chain Interoperability Protocol (CCIP), which facilitates seamless token transfers between altcoins.

Synergies with altcoins are evident in projects like Aave on Polygon, where Chainlink oracles provide real-time collateral valuations for lending, or Synthetix on Optimism, using feeds for synthetic asset pricing. Recent developments include Stellar’s adoption of Chainlink’s Data Feeds and CCIP to enhance DeFi on its network, enabling next-gen applications with real-world data streams.

In fintech, Chainlink bridges traditional finance with blockchain. For instance, partnerships with institutions like JPMorgan and Ondo Finance use oracles for tokenized asset settlements. Integrating real-time market data into altcoin-based smart contracts. This trend underscores Chainlink’s role in the tokenized economy, where altcoins serve as rails for real-world assets like bonds or commodities.

To visualize Chainlink’s market performance amid these trends, consider its price history. The token has experienced volatility, reflecting broader crypto cycles, but steady adoption has driven periodic uptrends.

Chainlink Price History and Trends : r/LINKTrader

For an interactive view, check the Chainlink/USD chart on TradingView: https://www.tradingview.com/symbols/LINKUSD/.

Pros, Risks, and Common Misconceptions

Chainlink’s decentralized structure offers clear advantages: enhanced security through multiple data sources. Reducing the risk of single-point failures that have plagued centralized oracles in past DeFi hacks. Its blockchain-agnostic design fosters synergies with altcoins, allowing protocols on Binance Smart Chain or Avalanche to leverage the same reliable feeds as Ethereum-based ones. This interoperability boosts efficiency, with features like Automation enabling event-triggered executions, such as liquidations in lending platforms.

However, risks exist. Oracle networks can still face data quality issues if node operators collude, though Chainlink mitigates this via staking and reputation systems. Economic attacks, where bad actors stake large amounts to manipulate data, are theoretically possible but deterred by high costs in a mature network. Additionally, reliance on external APIs introduces off-chain vulnerabilities, like source downtime.

A common misconception is that Chainlink is merely a price oracle provider. In reality, it extends to verifiable random functions (VRF) for fair gaming on altcoins like Polkadot, proof-of-reserve audits for stablecoins, and even privacy-preserving computations. Another myth: oracles centralize blockchains. Chainlink’s DON model actually preserves decentralization by distributing trust across independent operators.

Actionable Insights for Investors and Observers

For those eyeing Chainlink’s ecosystem, monitor key metrics like total value enabled (TVE). Which tracks the economic activity secured by its oracles—currently in the tens of trillions. Watch for expansions in CCIP adoption, as it could accelerate altcoin interoperability and drive LINK demand for fees.

Consider how Chainlink fits into diversified portfolios: its utility in DeFi makes it a foundational play, complementing altcoins focused on scalability or privacy. Track partnerships with enterprises like Swift or Euroclear, which signal institutional buy-in. For beginners, start by exploring the Chainlink Ecosystem directory to see live integrations.

To deepen understanding, view this explainer video on Chainlink’s oracle technology: https://www.youtube.com/watch?v=8XzRiZKp_iI. It breaks down the mechanics in under 10 minutes.

Conclusion: A Long-Term Pillar of the Tokenized Future

Chainlink’s oracles are quietly reshaping how altcoin smart contracts engage with the real world. Fostering a more interconnected and efficient DeFi landscape. As blockchain adoption grows, its role in enabling secure, data-rich applications will likely endure, supporting the shift toward a tokenized global economy.

What if oracles like Chainlink unlock not just DeFi, but entirely new financial systems—how might that redefine your investment strategy?

(Note: This is not financial advice. Crypto is volatile; always DYOR and only invest what you can afford to lose.)

References:

- Chainlink Official Site: https://chain.link/

- Messari Report on Chainlink: https://messari.io/report/chainlink-a-full-stack-institutional-platform

- Chainlink Blog on Integrations: https://blog.chain.link/united-states-department-of-commerce-macroeconomic-data/

- Stellar Foundation Announcement: https://stellar.org/blog/foundation-news/stellar-to-join-chainlink-scale-and-adopt-data-feeds-data-streams-and-ccip-to-power-next-gen-defi-applications