In 2026, blockchain technology in 2026 stands as a foundational pillar of digital innovation, powering everything from secure transactions to transparent supply chains.

The Complete Beginner’s Guide to Understanding Blockchain Technology in 2026

In 2026, blockchain technology in 2026 stands as a foundational pillar of digital innovation, powering everything from secure transactions to transparent supply chains. As adoption accelerates, understanding this technology becomes essential for investors and professionals alike. This guide breaks it down simply, without the hype.

Blockchain, at its core, is a decentralized digital ledger. It records transactions across multiple computers in a way that ensures security and transparency. No single entity controls it. Instead, participants in the network verify and maintain the records collectively.

Why does this matter now? With global spending on blockchain solutions expected to hit $19 billion in 2026, according to recent reports, its influence extends far beyond cryptocurrencies. Businesses are integrating it to solve real problems, from fraud prevention to efficient data sharing.

How Does Blockchain Work? Explained

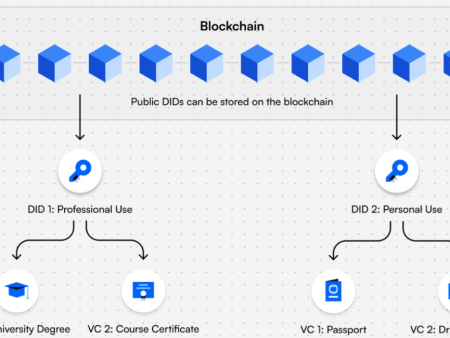

Alt: Simple diagram explaining blockchain technology in 2026. Image size: 300×200 webp.

What Is Blockchain? A Simple Explanation

Imagine a shared notebook where everyone can write entries, but once written, they can’t be erased or altered. That’s blockchain in essence. It’s a chain of blocks, each containing data, a timestamp, and a link to the previous block.

The “decentralized” part means no central authority—like a bank—oversees it. Copies of the ledger exist on thousands of computers worldwide. This setup makes tampering nearly impossible.

In 2026, blockchain technology in 2026 has evolved. Early versions, like Bitcoin’s, focused on finance. Today, it’s adaptable for various uses, thanks to advancements in scalability and speed.

How Blockchain Works: The Basics

Let’s dive into the mechanics. Blockchain operates through a network of nodes—computers that store and validate the ledger.

When a transaction occurs, it’s grouped into a block. This block must be verified before addition to the chain.

Verification happens via consensus mechanisms. These are rules ensuring all nodes agree on the ledger’s state.

The most common is Proof-of-Work (PoW). Miners solve complex puzzles to add blocks. It’s secure but energy-intensive. Bitcoin uses this.

Proof-of-Stake (PoS) is an alternative. Validators are chosen based on their stake in the network. It’s more efficient, used by Ethereum post-2022 upgrade.

Other mechanisms include Delegated Proof-of-Stake and Proof-of-Authority, each suiting different needs.

Once consensus is reached, the block is added. A cryptographic hash links it to the prior one, creating an immutable chain.

If someone tries to alter a block, it breaks the chain. The network rejects it.

Simple analogy: Think of blockchain as a group project where everyone has a copy of the document. Changes require group approval, and history is preserved.

Alternative consensus algorithms | Blockchain Technology and …

Nodes and Decentralization: The Backbone

Nodes are the unsung heroes. Full nodes store the entire blockchain, validating every transaction. Light nodes handle less data for efficiency.

In a decentralized network, nodes communicate peer-to-peer. This eliminates single points of failure.

By 2026, node networks have grown massively. For instance, Ethereum boasts over 10,000 nodes globally, ensuring resilience.

This structure fosters trust. Participants don’t need to know each other; the system enforces honesty through code.

Real-World Examples Beyond Crypto

Blockchain technology in 2026 isn’t just about digital currencies. Its applications span industries, solving inefficiencies.

Supply Chain Management

Traceability is key here. Blockchain tracks goods from origin to consumer, reducing fraud and errors.

IBM’s Food Trust platform, used by Walmart, logs food journeys. A contaminated batch? Trace it in seconds, not weeks.

In 2026, luxury brands like Louis Vuitton use blockchain for authenticity. Buyers scan items to verify provenance.

This transparency cuts costs. A study shows supply chain blockchain reduces disputes by 50%.

Blockchain and Supply Chain Management – Deltec Bank and Trust

Voting Systems

Elections demand integrity. Blockchain enables secure, verifiable voting.

Platforms like Voatz have piloted mobile voting in U.S. elections. Votes are encrypted and stored immutably.

In 2026, countries like Estonia expand blockchain e-voting, boosting turnout while preventing tampering.

Analogy: It’s like a tamper-proof ballot box where every vote is publicly auditable, yet voter privacy is protected.

Challenges remain, like digital divides, but potential for fairer democracy is huge.

A Blockchain voting systems architectural overview

Healthcare Applications

Patient data silos hinder care. Blockchain unifies records securely.

MedRec, an MIT project, lets patients control their data. Doctors access with permission, improving outcomes.

In 2026, amid data breaches, blockchain secures sensitive info. Pharma uses it to track drugs, combating counterfeits.

According to Deloitte, 55% of healthcare execs see blockchain as a priority for interoperability.

Current Trends in Blockchain Technology in 2026

Adoption surges. Nearly 4% of the global population—over 283 million people—uses blockchain, per Demand Sage.

Interoperability is hot. Projects like Polkadot connect blockchains, enabling seamless data flow.

Tokenization of assets grows. Real estate, art—fractional ownership via blockchain democratizes investment.

Sustainability improves. PoS reduces energy use; carbon-neutral blockchains emerge.

In fintech, JPMorgan’s Onyx handles billions in transactions daily.

Healthcare and logistics lead non-finance adoption.

The market reflects this: Projected to grow from $33 billion in 2025 to $393 billion by 2030, at 64.2% CAGR, says MarketsandMarkets.

For visual insight, here’s a projected growth chart:

Note: Based on approximated growth from MarketsandMarkets data; actual figures may vary.

Pros, Risks, and Common Misconceptions

Pros abound. Security: Hacking one node doesn’t compromise the network.

Transparency: Auditable ledgers build trust.

Efficiency: Cuts intermediaries, speeding processes.

Yet risks exist. Scalability: Some blockchains handle few transactions per second.

Regulation: Varies globally, creating uncertainty.

Energy: PoW’s footprint draws criticism, though alternatives mitigate.

Misconception: Blockchain equals Bitcoin. No—it’s the underlying tech, applicable broadly.

Another: It’s unhackable. While resistant, smart contract bugs can be exploited.

Privacy concerns: Public ledgers reveal transactions, but zero-knowledge proofs address this.

Actionable Insights for Readers

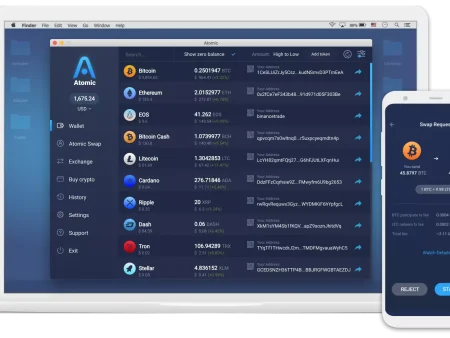

Start small. Explore wallets like MetaMask to understand basics.

Watch trends: Follow interoperability projects and regulatory shifts.

For investors, consider diversified exposure via ETFs tracking blockchain firms.

Research companies: Nvidia powers mining; IBM leads enterprise solutions.

Attend webinars or read whitepapers from sources like Ethereum.org.

Think long-term: Blockchain technology in 2026 is maturing, but volatility persists in related assets.

Conclusion: A Long-Term Perspective

Blockchain technology in 2026 represents a shift toward decentralized, trustworthy systems. From supply chains to voting, its impact grows steadily. As barriers fall, expect wider integration.

What role will blockchain play in your industry by 2030?

Top Ten References Used for This Article

- Grand View Research: Blockchain Technology Market Size Report, 2030. Link

- MarketsandMarkets: Blockchain Market Size, Share, Trends. Link

- Demand Sage: Blockchain Statistics 2026. Link

- Built In: 23 Blockchain Applications 2025. Link

- PMC: Blockchain in Healthcare. Link

- Blockchain Council: Top 10 Real-World Applications. Link

- VanEck: Top Blockchain Companies 2026. Link

- Fortune Business Insights: Blockchain Technology Market. Link

- Binariks: Blockchain Trends 2026-2030. Link

- AIMultiple: 15 Blockchain Case Studies 2026. Link

(Note: This is not financial advice. Crypto is volatile; always DYOR and only invest what you can afford to lose.)