From Fees to Global DeFi Infrastructure | Binance Blog

Introduction: Why BSC Matters in the Evolving Crypto Landscape

The crypto market shifts rapidly. Binance Smart Chain (BSC) stands out. It offers low-cost transactions. This draws developers and users alike.

In 2026, BSC could lead altcoin growth. Why now? Regulatory clarity grows. Adoption surges in gaming and DeFi. Investors seek efficient chains beyond Ethereum.

BSC processes transactions fast. Fees stay minimal. This ecosystem nurtures low-cost altcoins. They thrive amid high gas costs elsewhere.

Readers, consider this. BSC’s total value locked (TVL) hit $6.527 billion in December 2025. That’s real traction. It signals potential for 2026.

Yet, challenges persist. Centralization debates linger. Still, BSC evolves. Its roadmap integrates AI and security.

Understanding BSC: Core Concepts in Plain English

BSC is a blockchain. It runs parallel to Binance Chain. Think of it as Ethereum’s faster cousin.

It uses Proof of Staked Authority. Validators stake BNB tokens. This secures the network.

BNB is the native token. It pays fees. It enables governance. Users hold BNB for discounts on Binance exchange.

BSC supports smart contracts. It’s EVM-compatible. Developers port Ethereum apps easily.

Imagine a highway. Ethereum is congested. BSC offers express lanes. Low fees attract DeFi and gaming projects.

Tokens on BSC are BEP-20. They mimic ERC-20 standards. This boosts interoperability.

In DeFi, users lend, borrow, swap. Gaming uses NFTs and tokens. BSC hosts both efficiently.

Current Trends: BSC’s Role in Gaming and DeFi

Trends shape BSC’s future. DeFi dominates. PancakeSwap leads with $2.261 billion TVL.

https://t.co/Gnc0n9lX8w presents the BSC DeFi landscape …

Venus follows at $1.496 billion. These protocols offer yields. They draw liquidity.

Gaming grows too. opBNB, a BSC layer, leads with 1.05 million active wallets in Q3 2025.

Projects like DINOPARK thrive. Revomon attracts users. They use low-cost tokens for in-game economies.

How to Create a Token on Ethereum, BSC & Solan

Memecoins surge. Launchpads boost new tokens. AI integration enhances dApps.

Real-world assets (RWAs) emerge. BSC plans tokenization of real estate by 2026.

BNB price reflects this. It traded near $828 in December 2025.

Binance Coin Price Chart — BNB USD — TradingView

Burn mechanisms reduce supply. This supports value over time.

Cross-chain bridges expand. Liquidity flows freely. This ties BSC to broader ecosystems.

Pros, Risks, and Misconceptions of BSC Altcoins

Pros start with costs. Transactions cost pennies. This beats Ethereum’s fees.

Speed impresses. Blocks confirm in seconds. Users avoid delays.

Ecosystem richness helps. Thousands of dApps exist. DeFi yields compete well.

For altcoins, low entry barriers shine. New tokens launch cheaply. This fosters innovation.

Yet, risks loom. Centralization ties to Binance. Regulatory scrutiny could impact.

Security incidents happen. Hacks drained funds before. Users must vet projects.

Volatility persists. Altcoins swing wildly. Market downturns hit hard.

Misconceptions abound. Some call BSC “centralized Ethereum clone.” But it decentralizes gradually.

Another myth: Only memecoins thrive. DeFi and gaming prove otherwise.

Scalability upgrades address congestion. Rust implementation boosts performance.

Weigh these carefully. BSC offers opportunity. But due diligence matters.

Actionable Insights for Investors

Watch BNB burns. They reduce supply quarterly. This could lift prices.

Monitor TVL growth. Rising figures signal health. Track DefiLlama for updates.

Explore DeFi protocols. PancakeSwap offers swaps. Venus suits lending.

In gaming, try Revomon. It shows token utility in play-to-earn.

Diversify holdings. Mix BNB with altcoins like CAKE or BAKE.

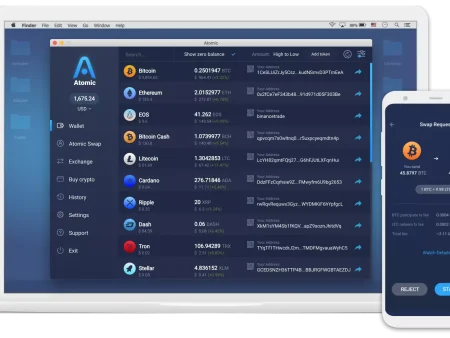

Use wallets like Trust Wallet. They support BSC seamlessly.

Stay informed on roadmaps. AI tools could transform dApps.

Consider staking BNB. It earns rewards. Boosts network security.

Think long-term. Short-term volatility fades. Focus on adoption.

Research projects deeply. Check audits. Read whitepapers.

Conclusion: Embracing BSC’s Long-Term Potential

BSC positions for 2026 success. Low-cost altcoins drive growth. Gaming and DeFi lead.

Its ecosystem matures. Upgrades enhance scalability. AI adds edge.

Challenges remain. Yet, resilience shows. Adoption builds steadily.

Investors gain from efficiency. Developers find fertile ground.

BSC isn’t just a chain. It’s a hub for innovation.

As crypto evolves, BSC adapts. It could redefine altcoins.

What if BSC becomes the go-to for everyday blockchain use?

(Note: This is not financial advice. Crypto is volatile; always DYOR and only invest what you can afford to lose.)