From Lawsuit to Leadership: XRP’s Path Under Pro-Crypto Regulators Selig and Atkins

From Lawsuit to Leadership: XRP’s Path Under Pro-Crypto Regulators Selig and Atkins

XRP’s path under pro-crypto regulators marks a pivotal shift for digital assets. Once entangled in legal battles, XRP now stands poised for growth. This evolution matters today as clearer rules emerge in 2025.

2+ Hundred Xrp Down Royalty-Free Images, Stock Photos & Pictures …

The Ripple-SEC Saga: A Recap in Plain Terms

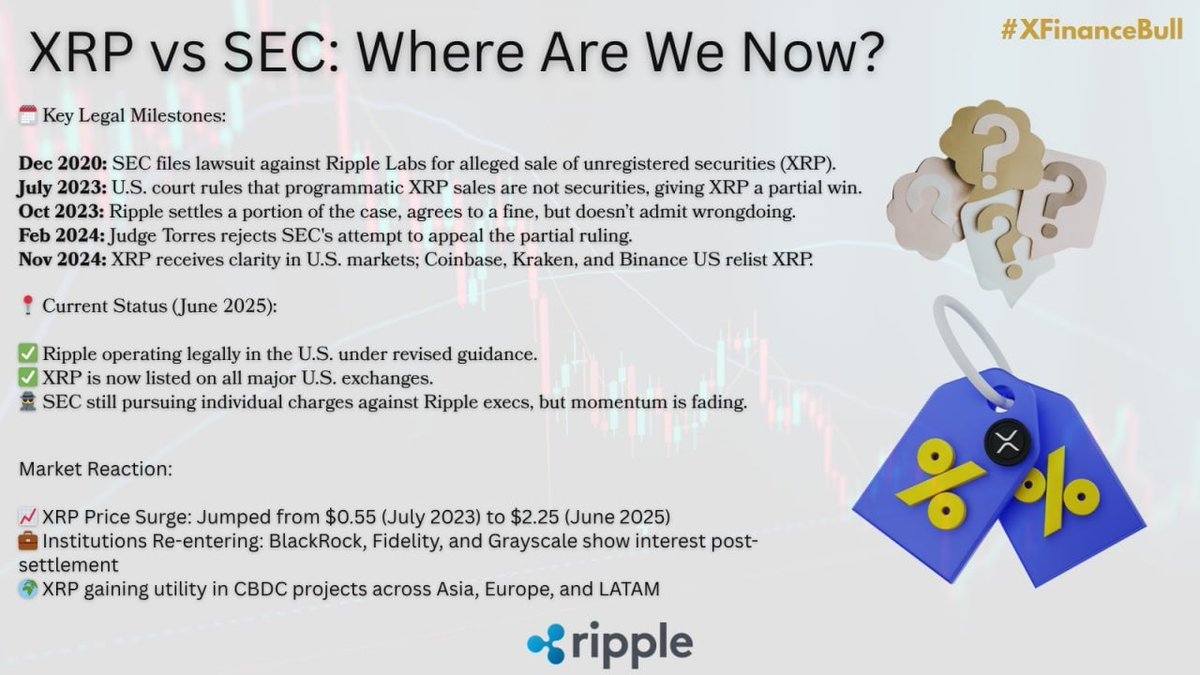

Ripple Labs faced the SEC in late 2020. The agency claimed XRP sales violated securities laws. Ripple raised over $1.3 billion through XRP, per the suit.

In July 2023, Judge Analisa Torres ruled partially for Ripple. XRP itself isn’t a security. Sales on exchanges to retail buyers? Not securities. But direct sales to institutions? Those were.

This split decision was a win for crypto. It clarified that secondary market trades often escape securities tags. The case dragged on, though.

By 2025, resolution came. The SEC settled in May, returning $75 million to Ripple. Appeals dropped. Fines totaled $125 million, far below the $2 billion sought.

X Finance Bull on X

Think of it like this: Imagine selling apples. If you sell to stores for resale, it’s just fruit. But promising buyers future orchard profits? That might be an investment contract.

The ruling boosted XRP’s price briefly. Yet, uncertainty lingered until the settlement.

XRP’s Path Under Pro-Crypto Regulators: A New Era Begins

Enter Paul Atkins and Michael Selig. Atkins took the SEC chair in April 2025. Selig became CFTC chair in December 2025. Both favor crypto innovation.

Atkins, a former SEC commissioner, pushes for clear rules. He criticizes “regulation by enforcement.” This means suing first, guiding later. Under him, the SEC has dropped crypto cases.

Selig, with SEC crypto task force experience, echoes this. He aims to foster digital assets at the CFTC. Together, they signal joint oversight.

For XRP, this duo changes everything. The CFTC views most cryptos as commodities. XRP fits here, per past statements. Ending enforcement-heavy tactics could free XRP for broader use.

In September 2025, the SEC and CFTC greenlit spot crypto trading rules. They dropped suits against firms. This shift aids XRP’s utility.

Current Trends: XRP in Cross-Border Payments and DeFi

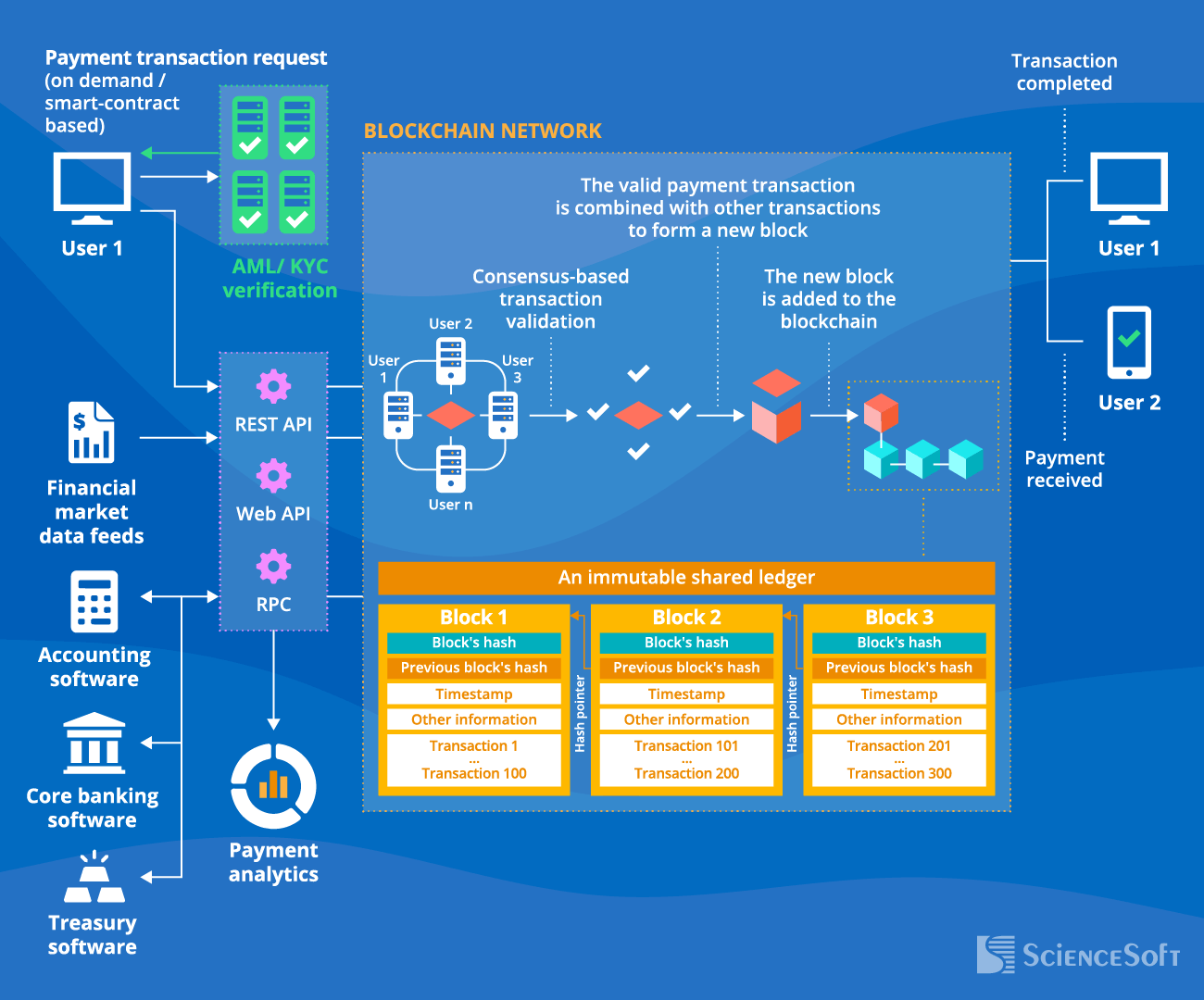

XRP shines in cross-border payments. Ripple’s On-Demand Liquidity (ODL) uses XRP to bridge currencies. It cuts costs and time versus traditional wires.

Swift takes days and fees stack up. XRP settles in seconds for pennies. Over 11,000 banks now tap the XRP Ledger (XRPL) for this, per recent reports. That’s a data-backed leap in adoption.

In DeFi, XRPL evolves. It supports tokenization and NFTs. Decentralized exchanges on XRPL let users trade without intermediaries.

Trends show growth. XRP lending launched in 2025. Institutions borrow XRP on-chain, like cash. This boosts liquidity.

Market stats reflect resilience. As of December 2025, XRP’s market cap hits $112.32 billion. Price hovers near $1.87, down 13% year-to-date despite wins.

Blockchain for Cross-Border Payments in 2025 ⛓️💰

Broader fintech integrates blockchain. Firms like JPMorgan test similar tech. XRP leads in real-world use.

Pros, Risks, and Misconceptions on XRP’s Path

Pros abound. Speed and low fees make XRP ideal for remittances. In DeFi, it enables yield farming without high gas costs.

Under Selig and Atkins, regulatory clarity could attract institutions. XRP ETFs launched in 2025, pulling $1 billion in inflows.

Risks persist. Volatility dogs crypto. XRP dropped 50% from July peaks. Centralization concerns arise; Ripple holds much XRP.

Misconceptions? Many think XRP is just Ripple’s token. False. XRPL is open-source. Anyone builds on it.

Another: All XRP sales are securities. The ruling debunked that for retail.

Regulation shifts help, but global rules vary. U.S. progress doesn’t fix everywhere.

Actionable Insights for Investors

Watch regulatory moves. Track Selig and Atkins’ joint statements. CFTC-SEC harmony could greenlight more XRP uses.

Monitor XRPL upgrades. Automated market makers enhance DeFi. Look for bank partnerships.

Diversify. XRP suits payments plays, but pair with Bitcoin for store-of-value.

Research volumes. XRP’s 24-hour trading hits $1.9 billion. High liquidity aids entries.

Stay informed via sources like CoinMarketCap or XRPL.org.

Consider long-term holds. XRP’s utility grows with adoption.

Conclusion: A Long-Term View on XRP’s Potential

XRP’s path under pro-crypto regulators Selig and Atkins transforms from defense to offense. Clear rules unlock payments and DeFi.

Challenges remain, but trends favor growth. Patience pays in crypto.

What if XRP becomes the standard for global transfers—could it redefine finance?

Ripple coin XRP cryptocurrency Golden and silver symbol and stock …

References

- SEC vs. Ripple: A Turning Point for US Crypto Regulation? – https://gordonlaw.com/learn/sec-turning-point-crypto-regulation/

- Ripple vs SEC: Full Case Timeline, Rulings, and 2025 Settlement – https://coincub.com/ripple-vs-sec/

- Statement on the Agency’s Settlement with Ripple Labs, Inc. – https://www.sec.gov/newsroom/speeches-statements/crenshaw-statement-ripple-050825

- Paul S. Atkins Sworn In as SEC Chairman – https://www.sec.gov/newsroom/press-releases/2025-68

- Michael Selig Sworn In as 16th CFTC Chairman – https://www.cftc.gov/PressRoom/PressReleases/9164-25

- Acting Chairman Pham Lauds DOJ Policy Ending Regulation by Enforcement – https://www.cftc.gov/PressRoom/PressReleases/9063-25

- XRP Ledger Home | XRPL.org – https://xrpl.org/

- XRP’s Untapped DeFi Potential: How earnXRP is Unlocking Sustainable Yield – https://www.ainvest.com/news/xrp-untapped-defi-potential-earnxrp-unlocking-sustainable-yield-opportunities-2512/

- XRP price today, XRP to USD live price, marketcap and chart – https://coinmarketcap.com/currencies/xrp/

- XRP 2025 Year in Review: Down 13% Despite SEC Victory and $1B ETF Inflows – https://247wallst.com/investing/2025/12/18/xrp-2025-year-in-review-down-13-despite-sec-victory-and-1b-etf-inflows-what-went-wrong/

(Note: This is not financial advice. Crypto is volatile; always DYOR and only invest what you can afford to lose.)